Editor’s note: Kelly Mathieson is the Chief Client Experience Officer at Digital Asset. This is Part VI in our post-trade transformation blog series. Don't miss the Introduction, Part I, Part II, Part III, Part IV, and Part V.

The upstream changes brought by tokenization and digitization to clearing and settlement and asset servicing will also affect value-added services provided on held assets later in the post-trade lifecycle. Like collateral management, securities lending will see significant shifts in legacy processes and business practices.

A brief definition

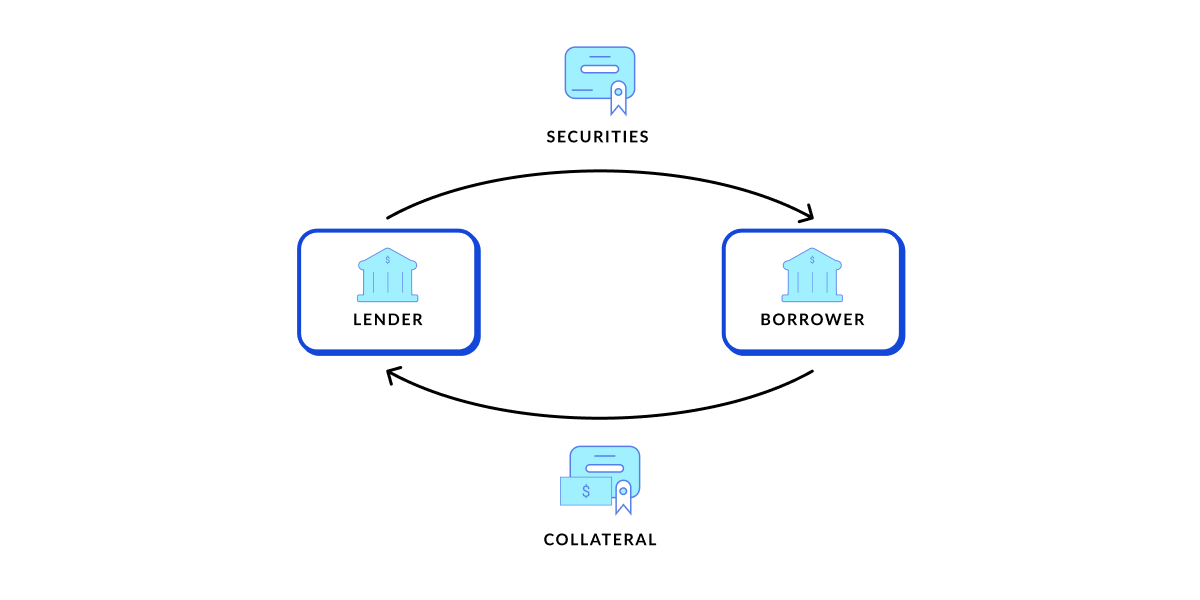

The $2.6 trillion dollar securities lending industry1 plays an important role in the smooth functioning of capital markets, enabling securities held in portfolios to be used for more transactions. Lenders are large portfolio managers and buy-side institutions who use this strategy to earn incremental portfolio returns and improve performance for the underlying investors (beneficial owners). Banks and broker dealers borrow securities to settle a specific transaction or in order to hedge, establish short positions, or facilitate market-making activities on their own behalf or for their clients.

Loans are short term and collateralized-based on the value of the securities, with daily adjustments based on market value fluctuations. The lender can reinvest the collateral, receiving income as well the borrowing fee for the loan. Lending can be direct, where counterparties arrange the transaction between themselves or through an agent acting as intermediary. Agency securities lending is generally provided by the custodian bank or large broker-dealer.

Legacy barriers to efficient lending

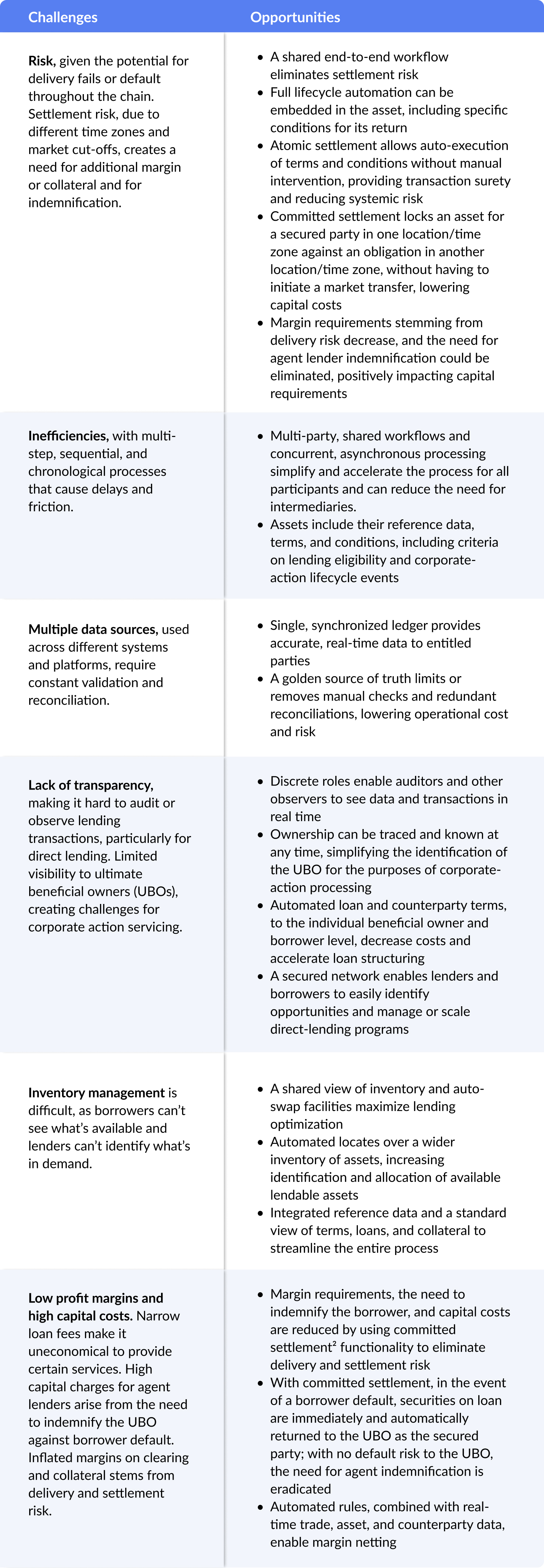

While securities lending enhances liquidity and efficiency across markets globally, like other post-trade services it involves a complicated network of inconsistent and siloed infrastructure across counterparties and intermediaries. Different legal agreements, market policies/protocols, and risk management strategies affect each loan and its associated collateral.

Many of lending’s legacy challenges can be addressed through distributed ledger technology and smart contracts.

Upstream developments drive downstream opportunities

As with collateral management, securities lending will be significantly altered by three fundamental changes earlier in the post-trade chain: With tokenized or digital-native assets, smart contracts, and DLT.

-

The unification of asset, data, and process in a digital asset enables an asset to be moved or transferred while keeping security, its reference data, and lifecycle events together. This allows for asset tagging, which embeds terms directly onto the asset and triggers its availability or eligibility status versus a particular counterpart or agreement.

As one of the banking activities that is “high-risk in corporate-action terms,”3 a digital lifecycle presents enormous opportunities for securities lending. Securities can be lent with or without rights. Based on the underlying loan agreement, the smart contract and embedded lifecycle data ensure a corporate-action event accrues to the correct entitled party. For example, automated recalls and substitutions over record date remove both corporate action and processing risk.

Furthermore, digitization solves the problem of identifying owners (to the UBO level) and eases the process of communicating with them, securing their votes, or managing payments. With atomic transactions, the owner of record is clear at any moment, making it easier for issuers to fulfill their legal obligation to inform the correct party.

A distributed ledger system has the capability to record positions at an end-beneficiary level. This increased transparency and resulting operational efficiencies open up opportunities for service providers alongside the custody chain.4

-

Atomic and committed settlement not only provides certainty of settlement, but also enables assets to be locked against a particular transaction or for a secured party. The implications for securities lending are profound:

-

Atomic settlement eliminates the need for clearing credit and its related capital charges, along with delays in settlement and associated bankruptcy risk. It removes the potential for bankruptcy stays to disrupt the process and reduces the need for margin.

-

Committed settlement uses a smart contract to lock assets to a particular recipient or transaction, rendering the system only able to deliver that asset to that recipient. Combined with the right legal framework,5 committed settlement can be used to create a first, perfected security interest in that asset with the intended recipient as the secured party. It helps identify safe-harbored transactions such as securities loans as exempt from bankruptcy stay, and could encourage regulators to revisit the capital requirements for these transactions. See specific legal opinions for English Law, U.S. Law, and Hong Kong and Australia for more details about committed settlement.

As a result, the need for margin and indemnification is drastically reduced, if not eliminated. Since the system prevents any use of the asset other than delivery to the intended recipient, the risk of non-performance for non-bankrupt entities is eradicated. In the event of a bankruptcy, participants in the system are assured that the intended participant has a perfected security interest in the asset and the transaction is safe-harbored. When the security can no longer be lost, there’s no need to indemnify the beneficial owner, rendering obsolete the capital charges associated with that indemnification.

Finally, if less margin is required, there’s a broader pool of assets available for lending or as collateral—or to be deployed in other financial transactions. Dispensing with indemnification would reduce costs, complexity, and capital utilization for agency securities lending transactions, making that service more profitable while reducing a potential drag on performance.

-

When assets no longer move in and out of custody control but actions are governed by a series of delegated permissions over sections of a workflow, many of the conditions that trap assets in a particular location disappear. This allows more assets to be lent or used as collateral. Physical commodities can also be tokenized, creating more high quality assets and injecting more liquidity into the entire financial ecosystem.

Substantial inefficiencies arise from the problem of inventory being located in places where the securities cannot be optimally deployed against relevant exposures in other locations. Market participants often hold the same type of assets across several custodians. The most optimal collateral cannot be accessed expeditiously or easily mobilized to their counterparty.6

The ability to lend securities by delegating permissions over specific workflows, regardless of where (or by whom) those assets are held, is likely to spur greater interest in direct lending. Direct lending allows the lender to realize more of the returns, although not every organization has the size, scale, or desire to manage their own lending activities. Agent lenders continue to play an important role, providing oversight and fiduciary responsibilities. However, the services provided by agent lenders are likely to change when they don’t need to tap their institutional balance sheet for indemnification or hold the asset in custody before it can be lent.

Unexpected benefits from post-trade innovation

As discussed in our collateral management blog, Broadridge has used smart contracts and DLT to create a better and more efficient repo process. Their distributed ledger repo (DLR) platform provides a single platform for market participants to agree, execute, and settle repo transactions. It is designed to be extensible to other types of transactions, including securities lending and financing transactions.

Broadridge expected the biggest gains from DLR to be operational efficiencies, and those have certainly materialized. However, they have also seen unexpected borrowing and capital efficiency benefits. With underlying securities immobilized and ownership transferred using smart contracts, banks and broker dealers are able to borrow securities for shorter time periods to address specific business requirements. Securities can be borrowed intraday and for only a few hours, removing the need to hold the same level of capital that would be needed for an overnight transaction.

A look ahead

Committed settlement opens the door to customizable settlement timeframes, which could present even more demand and opportunities for shorter-term loans. In combination with smart contracts, it also enables greater flexibility in how rights are assigned: For example, it could become possible for the dividend payment to be assigned to the borrower while the UBO retains proxy voting rights, and the rates for that transaction could reflect that particular set of conditions.

Peer-to-peer (P2P) networks for direct lending are expanding, including the non-profit Global Peer Financial Association (GFPA) established by CALPERS, the State of Wisconsin Investment Board, and other beneficial owners. The potential removal of indemnification as a necessary service could provide a significant boost to P2P, since credit intermediation performed by the agent lender is seen as a key factor holding the P2P lending construct back.7 How much more flexibility could be created if GFPA could connect to a repo network (such as DLR) or to tokenization or payments networks? And what if different P2P networks could connect to one another, with locate functionality based on standardized, embedded, data?

That is the vision of an ever-expanding global economic network. Using underlying technology that enables interoperability and extensibility, solutions developed independently can interconnect. This creates opportunity for market participants to join together and for new, composable solutions to be built, driving additional efficiencies for frictionless collateral movements and expanding the asset pools and counterparties available for securities lending programs.

Up next: Fund services

Fund services sits at the critical intersection of investment and investor, providing a range of essential services including management, accounting, reporting, distribution, and fiduciary responsibilities. It relies on a complicated network of relationships, workflows, and information sources that are time-sensitive and often inefficient. As with other post-trade services, a DLT-driven solution for funds services could deliver significant process and data improvements, delivering more accurate information more quickly and reducing operational risk and expense. Stay tuned.

Related reading

Bridging the Collateral Divide, BNY Mellon and Euroclear, November 2021

Corporate Actions 2021: From issuer-ready to investor-ready, The ValueExchange, 2021

How Can Collateral Management Benefit from DLT?, Deutsche Börse AG | Deutsche Bundesbank, January 2020

Legal opinions on committed settlement

Linklaters and Digital Asset, Digital Asset’s Committed Settlement: Adoption under English Law, 2019

King & Wood Mallesons, Committed Settlement in Hong Kong and Australia, July 2019

Milbank LLP, Blockchain & Cryptocurrency Regulation (Second Edition), 2020

Citations

1Bridging the Collateral Divide, BNY Mellon and Euroclear, November 2021

2See specific legal opinions for English Law, U.S. Law and Hong Kong and Australia for more details about committed settlement.

3Corporate Actions 2021: From issuer-ready to investor-ready, The ValueExchange, 2021

4How Can Collateral Management Benefit from DLT?, Deutsche Börse AG | Deutsche Bundesbank, January 2020

5See specific legal opinions for English Law, U.S. Law and Hong Kong and Australia for more details about committed settlement

6Bridging the Collateral Divide, BNY Mellon and Euroclear, November 2021

7Global Investor/ISF, Summer 2021, p24

by Kelly Mathieson

October 31, 2022

by Kelly Mathieson

October 31, 2022

by Kelly Mathieson

October 31, 2022

by Kelly Mathieson

October 31, 2022

by Kelly Mathieson

October 31, 2022

by Kelly Mathieson

October 31, 2022