Editor’s note: Kelly Mathieson is the Chief Business Development Officer at Digital Asset.

Accelerating investor interest in trading overall, and digital assets in particular, is driving a steady flow of new assets, solutions, and providers in financial services and across post-trade processing.

According to a recent BNYMellon survey, 72% of institutional asset managers said they plan to develop solutions for asset tokenization, and 84% of institutional asset managers surveyed said they plan to develop blockchain and distributed ledger technology to synchronize data and processes.1

This wave of innovation sparks a host of questions. How might the rise of digitally native securities and digitization affect the familiar sequencing of post-trade services? Is it time to fundamentally re-examine the layers of processes, complex relationships, and workflows that have built up over time?

Certainly, post-trade services have morphed before. Consider how investor demand for global securities drove the creation of cross-border securities and the rise of central securities depositories. Think back to dematerialization, which enabled agents to develop value-added services once they could shift away from physically moving securities around.

Digitization will be even more transformative

From new entrants, to incumbent providers, to investors, everyone is figuring out how to operate in a digitized world.

“This is no longer an experiment. Our recent survey shows that 34% of the market has distributed ledger projects live in the market today, up significantly year over year. Another 31% are in the build phase, with 16% and 21% in the pilot and research stages, respectively.”

Barnaby Nelson, The ValueExchange

A number of initiatives are already underway. Some projects offer tantalizing glimpses of a digital future, but many are focused on improving existing processes. Operating more efficiently, safely, and cost effectively is critical to stable, thriving markets. However, if we focus only on crafting a better mousetrap, we will miss out on the true potential of digitization.

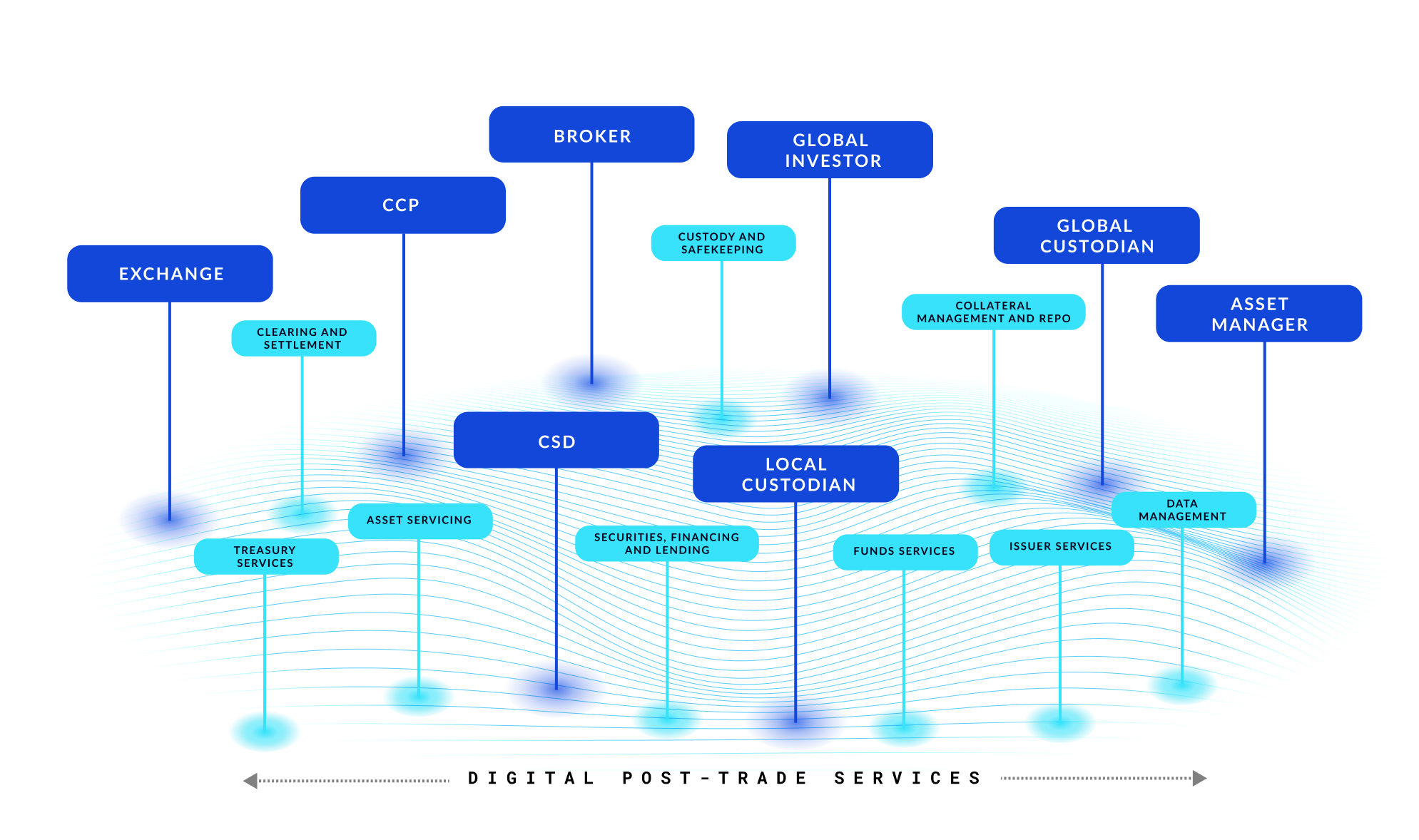

This blog series focuses on the power of digitized assets to radically reshape post-trade. Just as the internet dissolved boundaries for sharing data and information, we foresee the creation of networks that allow products and services from existing and emerging providers to connect in new ways. This will enable value to be transferred more freely, setting the stage for solutions we can’t even imagine today. Indeed, when organizations move beyond specific digitization initiatives to combining and linking their efforts, the entire post-trade world will change.

This shift is starting to happen today, as organizations move from solving internal problems and creating efficiencies to working across traditional partner and provider boundaries to tackle more systemic market challenges. Recent data from The ValueExchange reflects this new paradigm: 58% of respondents are focused on building relationships with ecosystem partners, while 43% are participating in market utilities or collaborative projects. That reflects a clear belief that value increases as the scope broadens.

In our examination of post-trade, we’ll explore the true impact of digital records and data, how mobilization accelerates even as the asset itself is immobilized, and why the old value chain of sequential post-trade services no longer applies. Finally, we’ll look at the potential for a universal network, which sits above and across solutions, and why that is just as critical as the foundational technology supporting individual services or providers.

Along the way, we’ll highlight tangible examples of existing and emerging use cases from the digital pioneers that are staking a claim in this new frontier.

Why now?

The opportunity is vast and we believe the time is right to reimagine post-trade. Countless studies, reports, and working groups cite the massive inefficiencies and costs associated with a post-trade infrastructure that has been built up, piece by piece, as securities markets evolved. That infrastructure currently manages more than $3,360 trillion worth of transactions, with quadrillions of securities processed and settled across major market infrastructures.

Although the system operates with remarkable resilience and effectiveness, if you were to set out to design it from scratch today, it would likely look quite different. As noted by the World Economic Forum, “Legacy processes and technology systems have created complexity, opacity, and fragmentation across markets, which likely has a meaningful impact on costs, market liquidity, and firms’ balance sheet capacity.” This reflects the current state of play, but the market is not static: new providers, asset classes, solutions, and investors emerge continuously.

At the same time, it is the size and scale of the current system that creates both the challenges and the potential. Imagine the possibilities if you could lower costs by at least 35%, reduce settlement time, or prevent the $27 billion of collateral settlement fails that we know take place, at a minimum, annually? Or what might happen to investment allocation and demand if clients could be onboarded and begin trading in a few weeks rather than six or more?

“Post-trade issues are costly, slow innovation, and increase risk.”

Bank of England, Post-Trade Task Force

What’s next?

In the coming months, we’ll delve into these questions and more, starting from the very beginning with a look at asset creation and issuance. As assets become digitized records, how do they behave? How does that affect the issuing entity and interactions of service providers?

Future chapters will focus on:

We believe that post-trade is on the brink of profound change. We hope you’ll join us for the exploration.

¹BNY Mellon, “Asset Management: Transformation Is Already Here, August 2021

by Kelly Mathieson

August 24, 2022

by Kelly Mathieson

August 24, 2022

by Kelly Mathieson

August 24, 2022

by Kelly Mathieson

August 24, 2022

by Kelly Mathieson

August 24, 2022

by Kelly Mathieson

August 24, 2022