Editor’s note: Kelly Mathieson is the Chief Client Experience Officer at Digital Asset. This is Part II in our post-trade transformation blog series. Don't miss the Introduction and Part I.

Smart contracts and digital assets have the power to transform the critical steps that move a trade into the post-trade space. Although securities are increasingly digitized, as discussed in our asset creation and issuance blog, clearing and settlement are only beginning to reap the benefits of digitization.

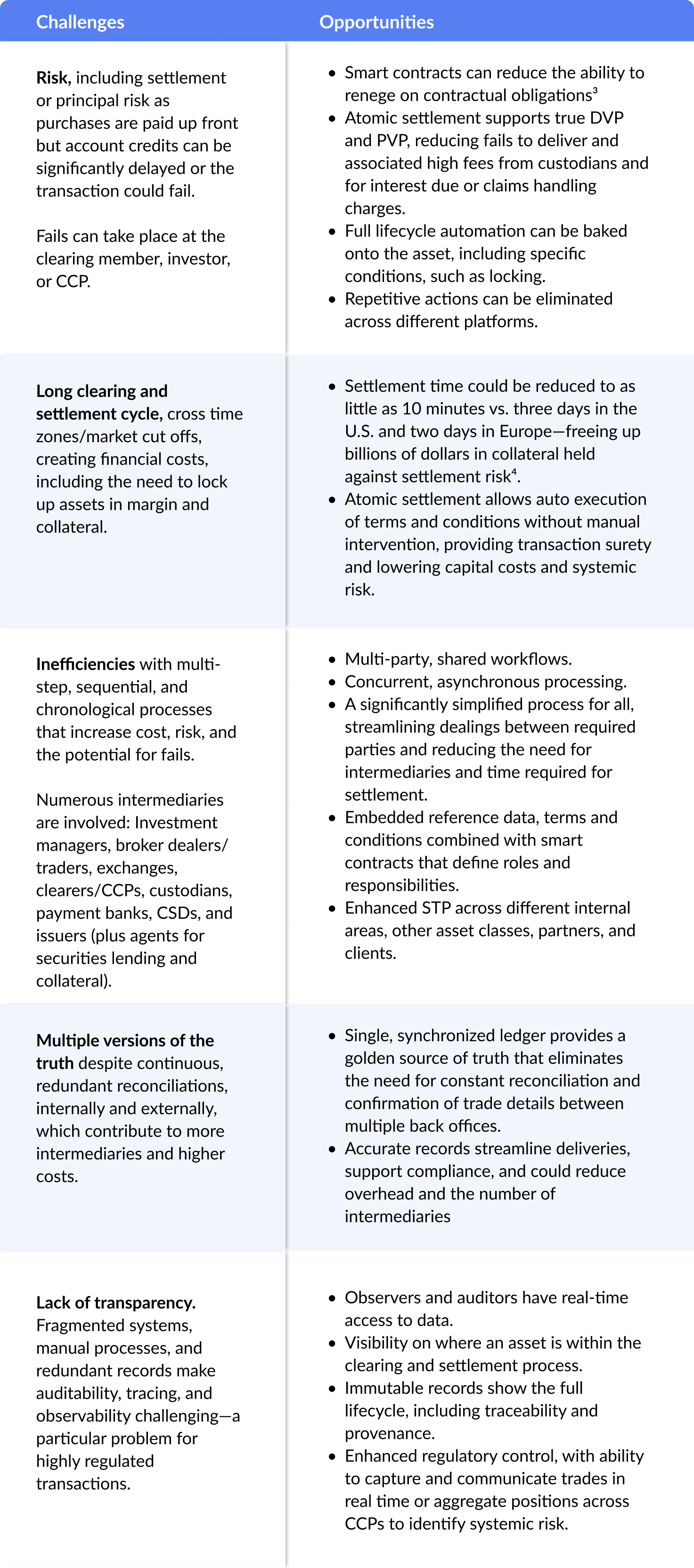

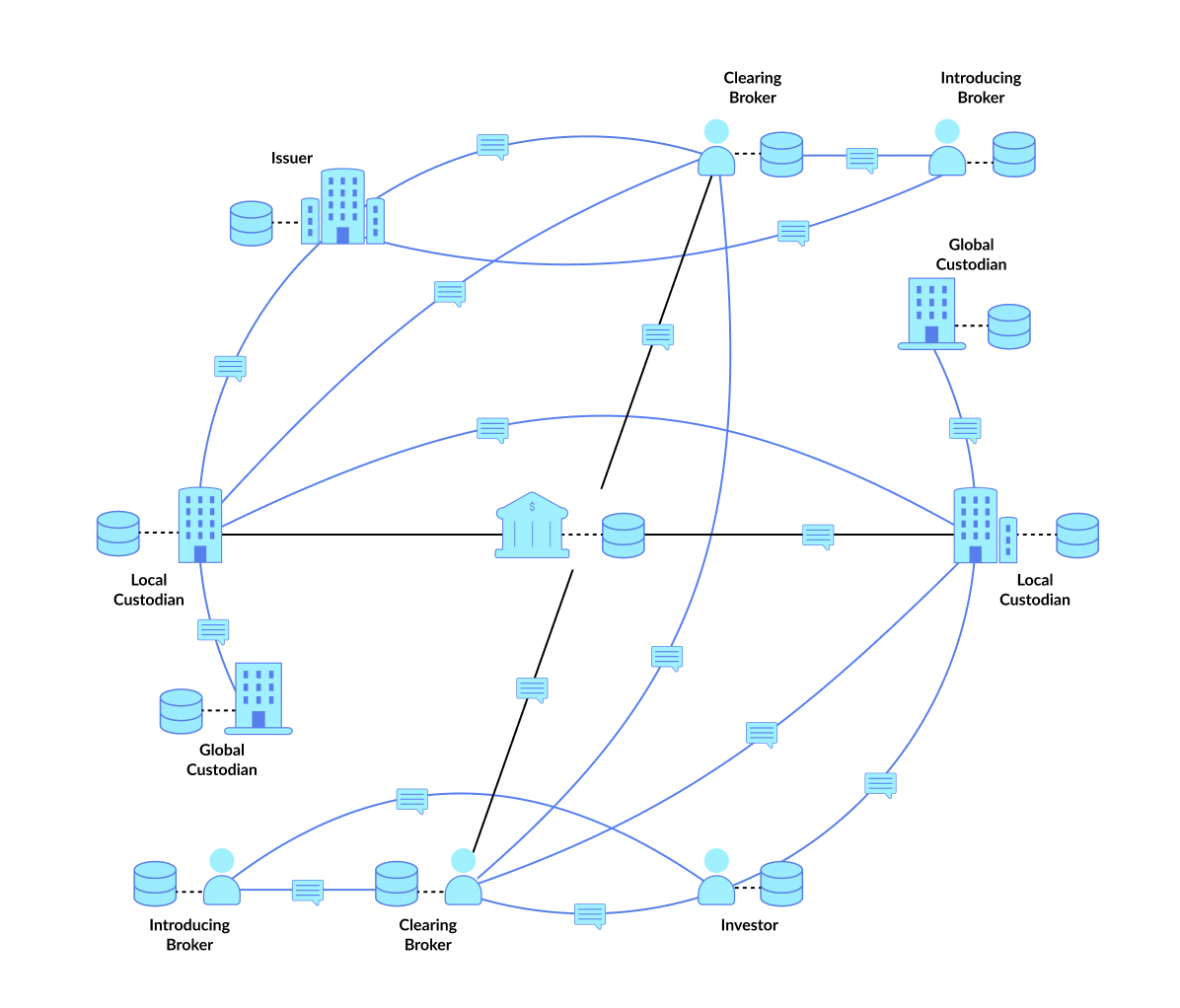

Despite significant changes over the last decade, clearing and settlement remain rife with inefficiencies driven largely by different regulations, jurisdictions, and the vast size¹ and complexity of the market. These include: A lack of transparent or agreed upon data; numerous agents and intermediaries validating and confirming another party’s actions; sequential processes bound by time zones and restrictive cut-offs; and layers of controls that seek to mitigate counterparty, liquidity, and settlement risk in the system.

The unification of data and process within a digital asset can address many of these inefficiencies, since assets can be transferred or moved along with their reference data and lifecycle events. For clearing and settlement, smart contracts and the ability to complete process steps at the exact same moment also create the conditions to go beyond efficiency and remove risk, opening the door to lower expenses and capital costs.

How can digital assets redefine clearance and settlement?

Even the most straightforward clearing and settlement process involves multiple institutions and steps executed within strict timeframes. Additional requirements—from regulations, jurisdictions, or intermediaries—layer on processes and require constant oversight, adding significant complexity to the system.

Distributed ledger technology can streamline reconciliation processes and reduce complexity in securities settlement, ultimately limiting the need for multiple intermediaries, lowering exposure to replacement cost risk, and potentially mitigating the need for central counterparties through simpler, more direct holding systems.²

The combination of digital assets, smart contracts, and DLT could reshape clearing and settlement by reducing or even removing systemic challenges.

The impact could be profound: Applying blockchain to clearing and settlement of cash securities, equities, repo, and leveraged loans could reduce settlement risk exposure by over 99% and save $11-12 billion.5 But the opportunity extends well beyond driving efficiency and decreasing cost.

Mind the gap: The case for atomic settlement

In traditional delivery vs. payment (DVP) settlement, a clearinghouse or other, independent third party typically facilitates the delivery of the asset in exchange for payment. Though often referred to as simultaneous, that is not accurate. In reality, this is a sequential process that is conditional on the delivery being made before the payment is released.

DVP reduces settlement and counterparty risk overall, but there is still a risk to the clearinghouse and additional time and cost from having other intermediaries involved. For bilateral payments, counterparty risk remains a significant factor.

“Blockchain-based multichain atomic swap technology will become a peer-to-peer alternative to a central clearing counterparty that normally facilitates the DVP settlement of financial assets.”6

Atomic settlement solves those problems by breaking each complex transaction into its atomic components and settling them all simultaneously—truly simultaneously. All conditions must be satisfied before the transaction can complete, meaning both payment and delivery must take place according to terms set forth in the smart contract for settlement to occur.

Atomic settlement removes the delta between delivery and payment, or, for example, with a CCP, of incoming and outgoing assets that comprise current day netting processes. The knock-on effect is to eliminate the need for margin postings or credit extensions, ultimately lowering capital requirements.

Next-generation settlement: Committed (or locked) settlement

It’s important to address inefficiencies to improve operations and sustain sound and healthy markets. Settlement risk is real and costly: Billions of dollars in collateral are held against settlement risk, and the DTCC estimates that a global failure rate of just 2% results in costs and losses of up to $3 billion.7 Settlement can fail, be called into question, or be challenged because of the default or bankruptcy of one party.

Is it possible to completely remove settlement and counterparty risk? Security pledges, control account agreements, and custodial account memo pledges were designed to do just that. However, these industry practices are rarely used, due to operational and/or cost challenges and cannot be scaled to accommodate individual movements of securities.

Committed—or locked—settlement offers the potential for transformation. This innovative application by Digital Asset allows the secured party to be secured in a more efficient way. Assets can be locked at location, eliminating market movements and securities deliveries. They can also be locked to an intended recipient, making the creation and maintenance of control accounts simple, routine, efficient, and cost-effective.

Combined with the right legal framework, it can:

- Render the system incapable of obeying any instruction other than delivering the asset to the intended recipient.

- Be used to create a first, perfected security interest in that asset with the intended recipient as the secured party.

- Help identify safe-harbored transactions (e.g., securities loans) as exempt from the bankruptcy stay.

By locking the asset, its movement happens automatically, removing the potential for human or system intervention. Providing settlement finality completely eliminates settlement and counterparty risk. The seller is guaranteed to receive the agreed-upon funds and the buyer to receive the assets. Importantly, until that transfer happens, the owner remains the legal owner.

The technology exists to achieve this. However, it is only valid if it can stand up in court during bankruptcy proceedings. Digital Asset has worked closely with legal experts in major markets, who have confirmed the ability of committed settlement to evidence certainty of settlement finality and stand up to respective bankruptcy laws. Opinions from Linklaters, King & Wood Mallesons, and Milbank LLP show the feasibility of financial markets to utilize committed settlement within the frameworks, respectively, of English, Hong Kong/Australia, and U.S. Law.

The opportunities of committed settlement

Locking the assets immobilizes them, allowing them to be used for one action and one action only. This removes the risk, which decreases associated margin and capital requirements. It also delivers significant operational benefits, including the elimination of duplicative settlement instructions and significant reduction of reconciliation and verification activity. Transparency is improved with an immutable, real-time record of all transactions across all accounts at the ultimate beneficial owner level, enhancing auditability and regulatory compliance.

Looking ahead, the ability to lock assets unlocks other opportunities:

- An asset can be locked for the entire duration of the settlement process or could be locked closer to the settlement date. For example, an asset that is due to settle in three days could be lent out or used as collateral for two days, with a smart contract that guarantees its return in time for settlement in accordance with the original trade. A delay in locking introduces risk, but that risk premia could be priced into the transaction.

- Locking could reduce settlement time by removing layers of validation and reconciliation by intermediaries. With surety of the asset, the parties could agree to an earlier exchange with confidence that both asset and cash will move automatically and simultaneously as the transaction completes.

- Assets could be locked for particular purposes. For example, the asset could be locked to the transfer while the actions required to service it remain accessible, simplifying corporate actions over record date.

- Safeguards can also be put in place. A contract could specify that if the asset is not transferred within a certain period, then the lock will ‘expire’ and the original owner will retain possession.

Asset locking has the potential to transform settlement and downstream activities such as collateral management and securities lending, creating new revenue opportunities and reducing costs with a streamlined process.

Industry pioneers are already tackling clearing and settlement inefficiencies

Multiple initiatives are underway to improve clearing and settlement, creating opportunity by simplifying a multi-layered process built up over time. While most initiatives are asset class or region specific, they are already creating measurable change.

Exberry and Baymarkets have introduced an end-to-end exchange, allowing digital asset marketplaces to be launched in days on a fully compliant platform that includes registry, trading, matching, clearing, and custody services. Millions of transactions can be cleared and settled quickly, using tightly integrated inventory and order management, which reduces risk and the need to hold excess capital.

“Having a CCP solution as part of the ecosystem adds efficiency of trade and settlement processing, credit risk mitigation and trust for the digital asset marketplace.” - Peter Fredriksson, Baymarkets Chairman of the Board

HKEX created Synapse, a straight-through post trade process with trade level privacy, to improve access to the HKEX Stock Connect program. Investors trade China-listed A-shares via Stock Connect, but out-of-time-zone participants faced a tight settlement cycle that placed exceptional reliance on local custodians and introduced unique settlement risks. Fully integrated into HKEX’s CCASS system, the Daml-driven workflow accelerates processing, eliminates errors, and decreases settlement risk.

“Synapse will be of major benefit to global investors when they trade through Northbound Stock Connect.” - Charles Li, Chief Executive (2010 - 2020), Hong Kong Exchanges and Clearing

Synfini, the Australian Stock Exchange’s DLT-as-a-service platform, lets customers build and connect to other DLT applications using Daml and VMWare Blockchain. Applications built in Daml can connect to ASX’s infrastructure and services and to each other, creating processing efficiencies in verifying transactions and sharing agreed workflows with any approved party. Early adopters include Broadridge, to automate and eliminate paper for off-market transfers in the equities market; Boulevard, with an ownership register for private companies; and DigitalX, which will use Synfini to host its RegTech Drawbridge application that reduces securities trading risks.

“With Synfini, ASX is providing an innovative solution for customers to enable the building of a diverse ecosystem of products and services.” - Dan Chesterman, ASX Group Executive, Technology and Data

These use cases demonstrate the power of amplification and interconnection. Applications that can interact with one another—forming and expanding networks—go beyond solving specific problems to create vast possibilities for customized service offerings, while still ensuring appropriate controls.

Global markets demand interoperability. Traditional assets and legacy platforms will coexist with digital assets and digital platforms for some time, and not all institutions will make the same technology choices or proceed at the same speed. It’s critical that the underlying technology can function across different systems, market infrastructures, and ledger providers or infrastructures. Only then can global markets remain global.

Stay tuned for our next blog: Custody and safekeeping

The transformational impact of atomic and committed settlement extends far into the value chain, affecting custody, collateral management, and securities lending. What are the implications of removing time-zone and settlement restrictions with asynchronous processing and improved, multi-party workflows? How does this affect interactions between global and local custodians and associated risk?

|

Clearing and settlement defined

During the settlement cycle (typically the one-to-three day period between the execution of a trade and final settlement), two processes take place:8

- Clearing: Trade details are reconciled by third parties to confirm what is to be settled. Clearing may include the offsetting or netting of trade obligations versus other transactions.

- Settlement: Ownership is transferred according to the terms of the underlying agreement. This is usually a two step process, even for book-entry securities. The delivery leg transfers ownership from the seller to the buyer, while the payment leg transfers the corresponding cash from the buyer to the seller.9

Depending on the asset, other components come into play. For example, derivatives transactions are, largely, centrally cleared following significant market reforms to reduce systemic risk.

- A central counterparty (CCP) steps in as counterparty and assumes the credit risk by novating the original trade and replacing each trade with two separate transactions. The CCP becomes the buyer to every seller and the seller to every buyer but is still subject to settlement risk.

- The CCPs net settlement and payment obligations against each entity, usually at end of day, to improve market efficiency.

- To address up-front risk, initial margin is posted with the CCP. To manage ongoing risk, variation margin is calculated and posted daily as value fluctuates, requiring transfers of cash or collateral.

Back to top section

|

Related reading

BIS, On the Future of Securities Settlement, March 2020

CapGemini, Blockchain Disruption in Security Issuance, 2016

DTCC, DTCC outlines path to reduce trade failures and increase security and efficiency of markets, April 2019

Forbes, Will Blockchain Replace Clearinghouses? A Case of DVP Post-Trade Settlement, December 2020

Linklaters and Digital Asset, Digital Asset’s Committed Settlement: Adoption under English Law, 2019

King & Wood Mallesons, Committed Settlement in Hong Kong and Australia, July 2019

Milbank LLP, Blockchain & Cryptocurrency Regulation (Second Edition), 2020

Citations

¹More than ~$3,360 trillion worth of transactions took place, with quadrillions of securities processed and settled across major market infrastructures. (2020 totals) How is Blockchain going to disrupt Capital Markets? Lucas Schweiger, 27 August 2021

²Definitions and process details drawn from BIS: On the Future of Securities Settlement, March 2020

³BIS: On the Future of Securities Settlement, March 2020

4Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 14)

5Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 14)

6Forbes, Will Blockchain Replace Clearinghouses? A Case of DVP Post-Trade Settlement, December 2020

7DTCC outlines path to reduce trade failures and increase security and efficiency of markets, April 2019

8Definitions and process details drawn from BIS: On the Future of Securities Settlement, March 2020

9Some transactions only have a delivery leg (e.g., collateral or securities lending). These free-of-payment (FoP) transfers often involve additional systems.

by Kelly Mathieson

September 1, 2022

by Kelly Mathieson

September 1, 2022

by Kelly Mathieson

September 1, 2022

by Kelly Mathieson

September 1, 2022

by Kelly Mathieson

September 1, 2022

by Kelly Mathieson

September 1, 2022