Editor’s note: Kelly Mathieson is the Chief Client Experience Officer at Digital Asset. This is Part I in our post-trade transformation blog series. Don't miss the Introduction.

Asset creation and issuance

Asset creation and issuance is the first link in the post-trade value chain. Without this, the assets for post-trade services simply don’t exist.

As markets have evolved, the shift from physical securities to digital representation has enabled dematerialization and immobilization of assets. However, securities issuance processes have remained firmly in the past, with even the introduction of ‘wet’ signatures heralded as a big innovation. Tokenization and digitization are revolutionizing this process from start to finish, both for traditional securities and the new asset classes that are constantly emerging.

We will explore the advantages that tokenization and the creation of truly digital assets are bringing to the asset creation and issuance process. We will also dig deeper into untapped opportunities—what might the future hold as the market embraces digitization? Along the way, we will look at how digital pioneers are already reshaping markets and reaping the benefits.

A brief definition

Current issuance processes are based on the creation, distribution, and management of physical documents (stock certificates, bond notes, etc.) administered using a traditional accounting book entry system. Once issued, the purchase/acquisition and subsequent trading of these securities documents is conducted via the securities exchanges (e.g., Nasdaq, NYSE, LSE, HKEX, et al.). Related financial transactions are processed through the established clearing system (e.g., DTCC).¹

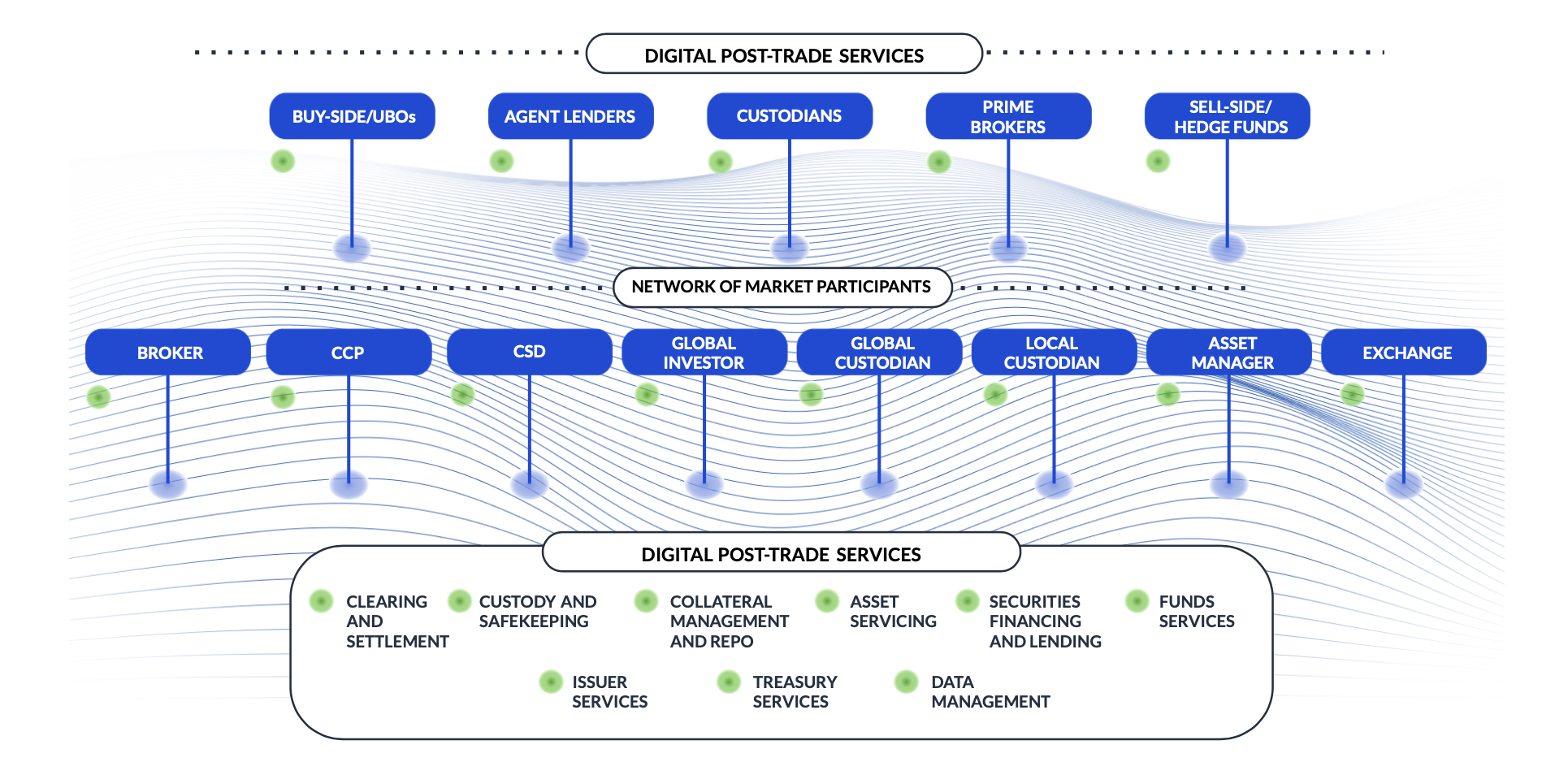

A simplified view of issuance includes structuring, issuance, distribution, primary listing, secondary trading, custody, portfolio management, advisory, and market making.² Each of these steps contains myriad sub-steps. It’s a time-consuming, manual process involving multiple players who execute a complex set of steps. The issuer works with investment bankers, lead managers, and syndicate members to structure an asset, which is then issued to asset managers and other investors. The entire process is overseen by regulators, ensuring compliance to required controls and regulations.

As the market continues to adopt structured products, the issuance process becomes even more complex. Increasingly, investors want investments that are tailored to their risk profile, so securities become composed of different sets of outcomes and risks. In response, the market is becoming more dynamic; yet the entire process is running on outdated technology that is sequential, slow, and not sufficiently scaled to handle digital assets. Increasingly, the infrastructure is not fit for purpose.

Modernizing asset creation and issuance

The issuance process is rooted in a time when participants gathered in a room to read and finalize offering memoranda and other documents, passing them from hand to hand for signatures. With processes and decision making that are largely sequential, it is fraught with delays that introduce risk and dilute opportunity.

“Digital technology would improve the efficiency of security issuance by replacing a paper-intensive, manual process with smart contract-led automation, reduction of intermediaries, and fully automated asset servicing through a distributed ledger.”3

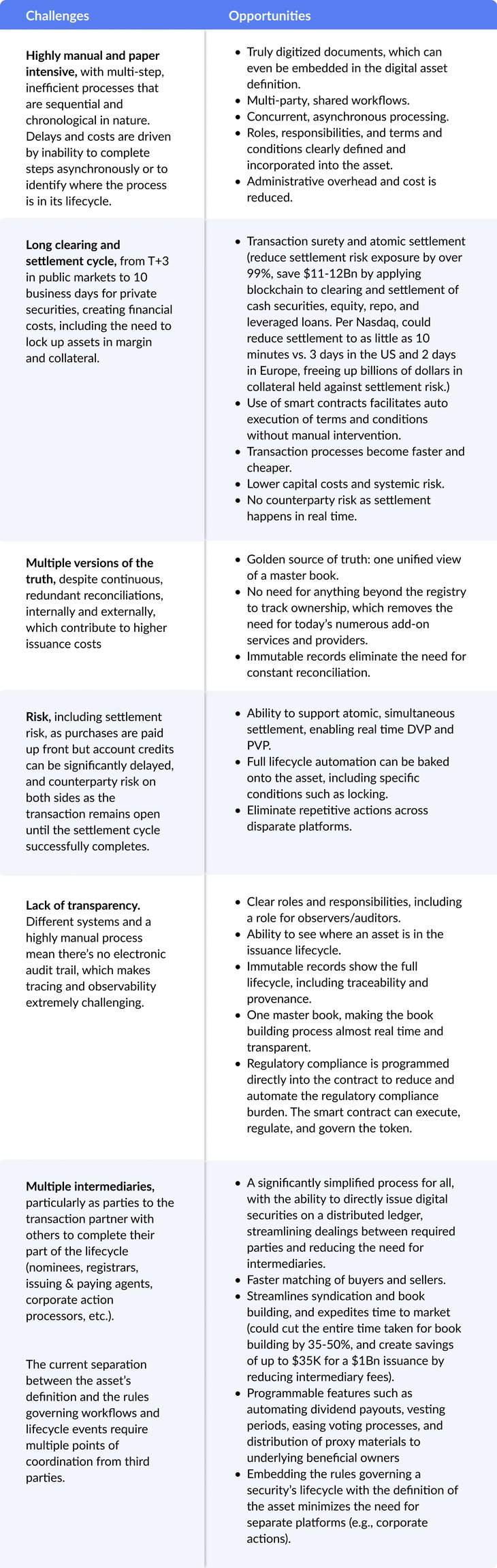

Multiple industry documents have outlined the pain points associated with asset creation and issuance, as well as the opportunities offered by digitization, smart contracts, and distributed ledger technology (DLT). See Related reading.

Beyond a better mousetrap

Most issuance discussions focus on improving the process, in order to reduce costs and create a better, safer, faster path to issuance. For all the reasons shown above, this is critical. But is it sufficient?

Securities are issued to secure funding, hedge risk, meet liabilities, or manage exposure. Issuers and investors alike are looking to capitalize on market trends or conditions, and every delay equates to lost opportunity.

Consider what could be unlocked with a nimbler process, standardized documentation, automated and transparent workflows, more flexibility, and faster time to market. Issuers and investors alike would benefit from faster execution to value. Now imagine what happens when the assets are created digitally—when the asset, the data, and the process are no longer three separate things, and transfers and moves can be executed while keeping the asset, its reference data, and lifecycle events together.

-

New types of assets and new use cases emerge. We see this already with tokenization of NFTs and artwork. Any type of asset could be tokenized–from physical assets such as gold, to regulated assets and structured products, to intangible assets like intellectual property or loyalty program benefits.

-

Faster time to market allows organizations to tap investor demand while interest is high. New products or funds are raised with expedited processes, helping companies capitalize on changing market trends and generate new revenues.

-

Investor interest increases with the flexibility to design unique terms and meet specific risk tolerances. Mobility, liquidity, and asset utility all increase,10 while counterparty and market risk decrease as settlement accelerates to near real time.

-

Geographic reach expands as geographic boundaries and market time zones become less relevant with asynchronous processing and a true master record. Different regulatory requirements can be encoded directly onto the asset and only triggered when specific conditions are met.

-

The investor base can broaden as investment thresholds and timeframes decrease. Specific, digital-only tranches can appeal to new investors.

-

More organizations can tap the markets as the complexity, cost, and time to issue securities decreases. (Bond origination is traditionally >USD300M.11) Fundraising becomes more efficient, and issuers have better information about their shareholders. Investment banks and syndicates can service more clients as onboarding, documentation, and workflows become streamlined.

-

The number of different entities involved in a trade could be reduced as the need for extra oversight or services is eliminated. And, as the market continues to get more efficient, might it allow a form of peer-to-peer asset creation and issuance, creating the ultimate in customizable assets and making it economically feasible for smaller or mid-size enterprises.

Faster, safer, expanded access to markets could help companies grow faster or investors better manage risk and capitalize on opportunities, opening the doors to a new era of competition and innovation.

How do we get there?

The key to transforming asset creation and issuance lies in tokenization and digitization and the ability to operate across disparate legacy systems and infrastructures, as well as digital exchanges. Smart contracts allow parties to define and agree on a process up front, creating transparent, multi-party workflows. With roles and responsibilities defined, terms embedded in the asset itself, and an accurate record, efficiency is injected into the process.

The entire workflow can be modeled within the functionality of the asset on the chain, and any asset can be tokenized as the bundle of rights and obligations with all involved parties and across the full lifecycle of the asset. Digital-native assets and dematerialized securities can benefit from these efficiencies, but the most significant benefit will come with paper-based securities—including securitized assets, equities/ETFs, private equity, and private debt, which were identified as the greatest area of focus and opportunity in a recent The ValueExchange survey.12 Activities take place asynchronously, dramatically speeding up processing time and reducing cost and risk. Manual processes and constant reconciliation are left in the past, and opportunity takes the place of errors.

Interoperability is crucial to allowing issuance to integrate seamlessly with the emerging digital market infrastructure and the mosaic of local, regional, and global legacy systems within post trade today. Not all organizations will make the same technology choices or move at the same speed, so an underlying technology that can function across different systems, ledger providers, or infrastructures is essential to seamlessly manage issuance, allocation, and settlement.

Milestones on the journey

Across markets and traditional/new asset classes, explore how organizations are forging ahead to redefine issuance with tokenization and digitization.

Project Genesis—Green Finance project13 is using asset tokenization to improve efficiencies in the distribution of green bonds along with more insightful reporting on the environmental impact of green bond proceeds. Project Genesis is a partnership between GFT, the Bank for International Settlements (BIS), the Hong Kong Monetary Authority (HKMA), Digital Asset and an extensive advisory panel.

-

This prototype introduces efficiencies in the distribution of green bonds to significantly accelerate a process that can take up to 28 days, while facilitating direct, real-time reporting on their environmental impact down to the individual bondholder.

-

The tokenized bond model drives substantial value by capturing bond lifecycle events (origination, issuance, subscription, allocation, coupons, redemptions and secondary market trading) and baking them onto the bond token itself. This enables end-to-end automation of the bond’s issuance and lifecycle process.

Working with DLT and Allinfra’s IoT technologies, a real-time trading platform promotes ecologically conscious trading. Bond tokens are enriched with a green data feed (e.g., direct feeds from metering devices attached to a solar farm), allowing traceability to any investor of the direct green impact of their investment—a level of transparency and accountability previously not possible.

Deutsche Börse—D7 Digital Ecosystem14 is using Daml for its D7® platform which creates and processes Digital Instruments – the digital description of electronic securities – and manages the securities alongside the entire value chain. D7 provides a fully digital alternative to conventional physical issuance and processing of securities, paving the way for same-day issuance and paperless, automated straight-through processing throughout the entire value chain of issuance, custody, settlement and asset servicing for digital securities. Using Daml, as the assets are created, the documentation for the structured product is embedded right in the asset contract itself. Along with the creation of a Daml-driven central registry, this streamlines the syndication and offering memorandum process. Investors can be truly informed, and shareholders have enhanced protection with readily-accessible up to date information.

Goldman Sachs—Tokenization Network is developing an end-to-end tokenized asset infrastructure that will support the entire digital lifecycle across multiple asset classes on permissioned and public blockchains. Using Daml, the rights and obligations are embedded directly into the asset. This enables complete modeling of the functionality of the asset on the chain with a structural representation of cash flows, events, and rights and obligations of the entire ecosystem of participants interacting with that asset.

With reusable, open-source building blocks, Goldman Sachs has been able to cut the time-to-value. As part of initial delivery, an asset bridge is being made available to them to facilitate the issuance and redemption (with controls) of native ethereum tokens representing an ownership interest in the Daml tokens managed, life-cycled, and controlled in the Goldman Sachs permissioned environment.

These use cases show the power of Daml-driven solutions. Each organization sought to address their own specific issue but, since any application created with Daml can connect to another, these solutions can interconnect to solve bigger challenges.

This creates the potential for an expanded network of market solutions that creates new standards for flexibility and efficiency, since each operator can define the rights and permissions for participants on their network and participants can select the services that they require. Market infrastructures have already been talking about how they can connect different applications. The focus is clearly broadening: a recent Value Exchange survey shows 58% of participants are focused on building relationships with ecosystem partners while 43% are participating in market utility or collaborative projects.15

Stay tuned for our next blog: Clearing and settlement

Over the past decade, clearing and settlement have seen significant improvement with the introduction of regulatory reforms designed to accelerate timeframes, provide safeguards, improve transparency and reduce risk. Smart contracts bring the promise of atomic settlement, which can increase certainty and reduce risk further. Our next blog will explore changes to clearing and settlement, including whether it is possible to completely remove settlement and counterparty risk.

Related reading

Webinar: Asset Tokenization Done Right, Digital Asset, CBOE and The Value Exchange, 2022

Blog: Tokenization done right, Digital Asset

Use case: Tokenization & Issuance, Digital Asset

Blockchain Disruption in Security Issuance, Capgemini, 2016

Tokenised Securities, ASIFMA, 2019

Digital Assets: From Fringe to Future, BNY Mellon, 2021

Citations

¹Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 4)

²Tokenised Securities, ASIFMA, 2019 (p. 7)

³Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 3)

4Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 14)

5CAP GEMINI: “Our research shows average fees paid are 3.45% for Regulation D (private security) issuance, 7% for an IPO issuance and 0.9% - 1.5% for a bond issuance. The cost could be reduced by eliminating the intermediaries involved, thereby improving efficiency and reducing cost to the issuer.”

6Tokenised Securities, ASIFMA, 2019 (p. 28)

7Tokenised Securities, ASIFMA, 2019 (p. 12)

8Blockchain Disruption in Security Issuance, Capgemini, 2016 (p. 11)

9Tokenised Securities, ASIFMA, 2019 (p. 12)

10Digital Assets: From Fringe to Future, BNY Mellon, 2021 (p. 6)

11Tokenised Securities, ASIFMA, 2019 (p. 12)

12Webinar: Tokenization Done Right (July 2022) - Digital Asset, CBOE, and The Value Exchange

13https://www.bis.org/about/bisih/topics/green_finance/green_bonds.htm

14https://www.deutsche-boerse.com/d7/

15Webinar: Tokenization Done Right (July 2022) - Digital Asset, CBOE, and The Value Exchange

by Kelly Mathieson

September 7, 2022

by Kelly Mathieson

September 7, 2022

by Kelly Mathieson

September 7, 2022

by Kelly Mathieson

September 7, 2022

by Kelly Mathieson

September 7, 2022

by Kelly Mathieson

September 7, 2022