Editor’s note: Kelly Mathieson is the Chief Client Experience Officer at Digital Asset. This is Part IV in our post-trade transformation blog series. Don't miss the Introduction, Part I, Part II, and Part III.

In addition to safekeeping, custodians are responsible for providing services on the assets they hold for the benefit of their investors. Asset servicing generally includes managing corporate actions, class actions, income processing, proxy voting, and tax reclaim.

Where they exist (and where spreadsheets are not prevalent), the average corporate action systems of bankers and brokers are nine years old. Thirteen percent are more than 20 years old¹, making corporate action systems the Model Ts of post-trade. They may still run, but, like a hand-cranked car on the Autobahn, these systems and processes are increasingly ill-suited for a modern, digitized world.

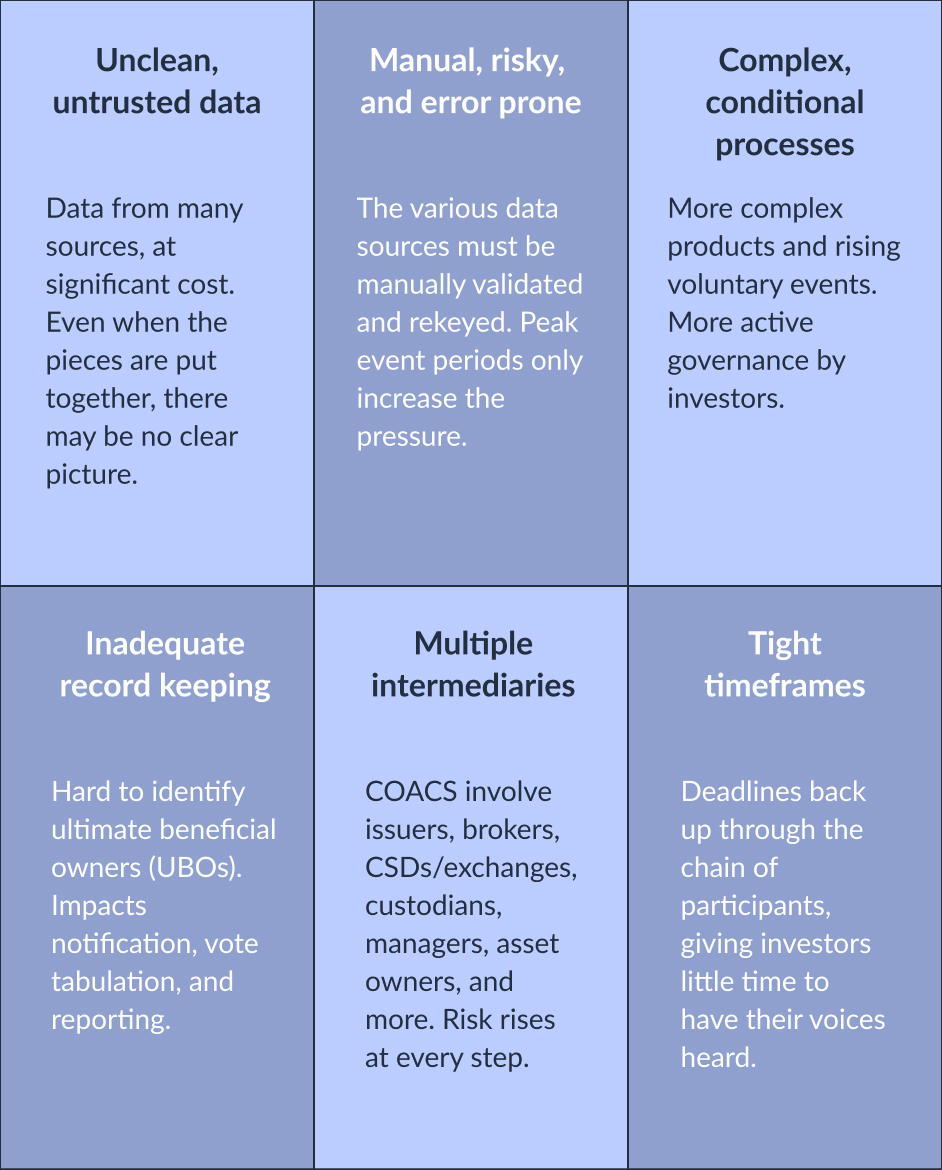

Corporate actions (COACs) are responsible for some of the highest error rates, costs, and risks in post-trade:

- In 2021/2022, 45% of brokers experienced errors of more than USD $1 million. In 2020, ~70% of business units around the world were paying out over USD $2 million in corporate action errors.

- Manual processes abound and introduce risk: 70% of brokers manually validate custodian feeds, and 50% of manual intervention is for voluntary events.

- Up to 7 different data feeds are used to source and validate corporate actions, driving high data costs and requiring significant headcount. Yet data is the root cause of 56% of COACs errors.²

Against this backdrop, consider that data is proliferating; data costs are rising rapidly; talent is getting harder to find and retain; and voluntary events are growing exponentially as issuers create new options for investors. Investors are also paying more attention: Beyond costs and errors, recent regulations like TCFD and SRD II require their more active participation in governance and as shareholders. A mid-point review of the 2022 proxy season notes that, so far, it “is characterized by increased scrutiny towards ESG matters”.³

The particular challenges of corporate actions

Within the themes explored in our earlier post-trade blogs, COACs have some unique attributes.

Given failing trades and settlement penalties, combined with audit, regulatory, and reputational risk, it’s no wonder that COACs have come into sharp focus.

“47% of the market now plans on running transformation projects in this space in 2022. Not only is corporate action change the largest area of industry transformation today—it is also the most urgent.”4

Barnaby Nelson, The ValueExchange

Many firms are looking to change their systems to reduce manual processes and associated operational costs. Since messaging automation alone could improve processing by up to 25%, providers are focused on ISO 20022 to improve straight-through processing, while investors are looking to APIs as an alternative to fax and email. Some are turning to vendor solutions, feeling that COACs can be more easily outsourced than other components of the post-trade value chain.

These efforts are focused on better managing processes that are cumbersome at best. Is that sufficient?

Eliminate, not manage: The promise of digital assets

Market forces are already driving the tokenization and digitization of assets to develop new types of securities, reach more investors, and improve trading and settlement. This inevitably creates benefits in the asset servicing space that, ironically, may prove bigger than the benefits on the front end.

“The issuance of digital securities on blockchain with smart contracts doesn't bring efficiency to the security issuance process only, but also provides advantage in other parts of the asset life cycle. By attaching the smart contracts to securities, the security becomes self-sufficient to auto-execute the corporate actions without any manual interaction or getting intermediaries involved.”5

As outlined in our asset creation and issuance blog, when you set up the digital expression of an asset or create a digitally native asset, its data and lifecycle events are intrinsic components. They remain together even during transfers and moves. As such, asset servicing information no longer needs to be gathered from external sources or validated.

This creates a true paradigm shift. All the costs and risks associated with multiple data sources, cross-checking, rekeying, interpreting, and reconciling simply evaporate. When assets include built-in information and events, there’s no scope for the data to be unknown or distorted.

The benefits begin to flow throughout the entire process:

- The time needed to process COACs could shrink to minutes (from days or even weeks for complex structured products) with a complete and transparent audit trail. Every step of the downstream and upstream flow of information is transformed: Fewer intermediaries are needed, repetitive data validation at every step is removed, and the only cut-off time that matters is the one set by the corporation. Investors have immediate access to the COAC as soon as the issuer publishes it to the blockchain, and they can take action on it right up until the deadline.

- Digitization solves the pernicious problem of identifying owners (including underlying beneficial owners), along with the processes and systems built up over time to communicate with those owners, secure their votes, or manage payments. Issuers are legally obligated to inform all legal owners and, where required, to collect votes through a chain of stakeholders. With atomic transactions, the owner of record is clear at any moment. Even if ownership changes shortly before a deadline, a digital COAC or proxy process can render the action of a prior owner obsolete and allow the new owner to participate.

- Safekeepers no longer need to manage the data or operational risk associated with COACs or hold capital against errors. Risk remains, of course, but is solely with the issuer, technology, or investor.

- A simplified process encourages more investors to take part in proxy voting, becoming more actively engaged in governance and achieving ESG goals. In 2021, institutional investors voted 92% of the shares they hold, but retail investor voting is at 28%—and retail investors own approximately 29% of shares.6

- The traditional pain points associated with class actions and tax reclaims, long recognized as massive and manual data exercises, also disappear. It becomes worthwhile for investors to participate and recapture all potential benefits or payments from class actions, while embedded tax rules can be compared with investors’ residency status to create opportunity for relief at source.

“With digital securities, smart contracts, and a distributed, synchronous ledger from front to back, you rip out 30 to 40 years of inefficiencies. You are genuinely talking about removing hundreds of billions of dollars in risk and associated countermeasures designed to remediate that risk.”

Barnaby Nelson, The ValueExchange

Beyond embedded data and lifecycle events, the impact of digitization on clearing, settlement, and safekeeping also can drive further efficiencies and reduce exposure. Atomic or committed settlement mitigates or eliminates counterparty and settlement risk, and an unbroken chain of control removes operating and liquidity risk (and their associated costs) from the process. Services become digitized and composable, removing the necessity for safekeepers to offer a full value chain of services simply because they hold the assets.

The seminal change is the ability to delegate responsibility over specific workflows within a digital process. The safekeeper could continue to manage corporate actions as an agent with permissioned responsibility over that portion of the workflow, or they could form or join new service partnerships and networks.

Steps on the journey and a glimpse of the destination

Digital Asset has created several asset servicing reference applications to demonstrate the impact of smart contracts and distributed ledger technology and accelerate implementation and adoption.

For corporate actions, the lifecycle data is stored with the asset, visible to participants and updated in real time as a golden-source record. All participants are notified as new events occur. Only the registrar has complete visibility to both owners (including UBOs) and their elections. A number of use cases have been explored, including dividend payments, renounceable rights (which can be traded), and bond servicing (calls/coupon payments/redemptions).

For proxy voting, the entire process is managed on a blockchain via smart contracts with clearly defined roles and permissions. Steps include meeting initialization., ownership record loading, voting rights allocation, proxy assignment, voting, meeting management, and post–meeting actions.

With the systemic issues inherent in asset servicing resolved, we could see a totally different, more sophisticated relationship between companies and investors. Communication becomes more immediate, and each side gains visibility into the actions and intent of the other—a sharp contrast from today when both parties are totally blind to one another.

Investors become more confident that they are realizing all the benefits of their investments and that their priorities are heard, while corporations get greater insight into the priorities and behaviors of their investors, which could lead to new investment products and enhanced opportunities for all parties.

Up next: Collateral management

With good reason, collateral management has been a hot topic since the global financial crisis. A critical tool for managing counterparty and credit exposure, collateral is used more widely and for more types of transactions than ever before. It was an early candidate for tokenization discussions given challenges in allocation, mobilization, optimization, and reuse.

In our next blog, we’ll take a deeper look at the opportunities that digitization and digital assets bring to collateral management.

Related reading

Charting the Future of Post Trade, Bank of England, 2022

Blockchain Disruption in Security Issuance, Capgemini, 2016

An early look at the 2022 proxy season, Harvard Law School Forum on Corporate Governance, June 2022

Asset Servicing Innovation, The ValueExchange, 2020

Corporate Actions 2021: From issuer-ready to investor-ready, The ValueExchange, 2021

LegacyTech: A case for post-trade transformation, The ValueExchange, 2022

Citations

1LegacyTech: A case for post-trade transformation, The ValueExchange, 2022

2Corporate Actions 2021: From issuer-ready to investor-ready (2021) and Asset Servicing Innovation (2020), The ValueExchange

3An early look at the 2022 proxy season, Harvard Law School Forum on Corporate Governance, June 2022

4LegacyTech: What is the change?, The ValueExchange, 2022

5Blockchain Disruption in Security Issuance, Capgemini, 2016

6Few individual investors participate in shareholder voting. Here’s how that may be changing., CNBC, October 2021

by Kelly Mathieson

October 11, 2022

by Kelly Mathieson

October 11, 2022

by Kelly Mathieson

October 11, 2022

by Kelly Mathieson

October 11, 2022

by Kelly Mathieson

October 11, 2022

by Kelly Mathieson

October 11, 2022