Editor’s note: Kelly Mathieson is the Chief Client Experience Officer at Digital Asset. This is Part III in our post-trade transformation blog series. Don't miss the Introduction, Part I, and Part II.

Our prior post-trade blogs covered the ability of digital assets to improve the issuance and asset creation process and how, in combination with smart contracts, they can enable true, simultaneous settlement with atomicity and remove counterparty and settlement risk completely through committed settlement.

Attention turns now to custody; more specifically, to the service and processes of safekeeping. Safekeeping global investments requires a complex arrangement of services provided within and across individual markets, with a host of follow-on services that are enabled by holding assets in an account. Safekeeping shares the same difficulties as other post-trade services: Data opacity, the lack of a golden record, multiple intermediaries, sequential processes, time zone challenges, and so on. Yet safekeeping also has some unique challenges.

Custodians strive to deliver a consistent investor experience over assets held in multiple markets with different rules and regulations, and to manage risk and liability while still supporting clients’ trading activities. A global custodian works with local custodians (sub-custodians) who have direct control over the end-user client assets under custody (AUC) and hold accounts at the in-country central securities depository (CSD) or central bank. Although the global custodian has only indirect asset control, they have the burden of direct—often fiduciary—liability over the AUC, including associated capital costs and risk.

Digitization enables a profound shift in how safekeeping services can be delivered: First, through the unification of data and process within a digital asset; second, with the ability of atomic or committed settlement to mitigate or eliminate counterparty and settlement risk; and third, with new flexibility offered by composable services.

“As the central source for assets across foreign and local markets, global custodians play a critical role in capital markets. From cross-border securities transactions to tax processing of asset holdings, global custodians are constantly faced with the burden of direct liability, along with the cost and risk associated with indirect asset control."¹

Custody and safekeeping defined

The traditional custody market is massive: As of June 30, 2022, the five largest global custodians had more than USD 173 trillion dollars in AUC.² The size of the market, volume of transactions, and breadth of market coverage are key drivers of operational complexity.

-

Custodians are responsible for safekeeping their clients’ assets in physical or electronic form, processing and settling associated transactions, and servicing the assets across multiple markets. This requires extensive relationships with local or sub-custodians.

-

Investors rely on a global custodian for access to global and local markets and their ability to deliver services through economies of scale. These include value-added services such as collateral management and securities lending, which are enabled by virtue of holding the assets.

Digital asset custody differs in that the custodian is primarily responsible for safekeeping the key that allows the digital assets to be cryptographically secured. There are currently several options for storing the investors’ private keys to safeguard the digital assets, each with distinct benefits and disadvantages. New alternatives will continue to evolve as digital custody solutions keep pace with a rapidly growing market. The digital asset management market size was valued at USD 3,497 million in 2021. It is estimated to reach USD 8,159 million by 2030, registering a CAGR of 18% during the forecast period (2022-2030).³

A bridge to span digital and traditional

The rise of digitally native assets and tokenized securities, coexisting with traditional assets, requires safekeeping that can accommodate both types of securities. No investor, and no service provider, will want to maintain two separate sets of technologies, processes, and workflows in perpetuity, particularly when the infrastructure supporting digital assets delivers such significant efficiencies and benefits.

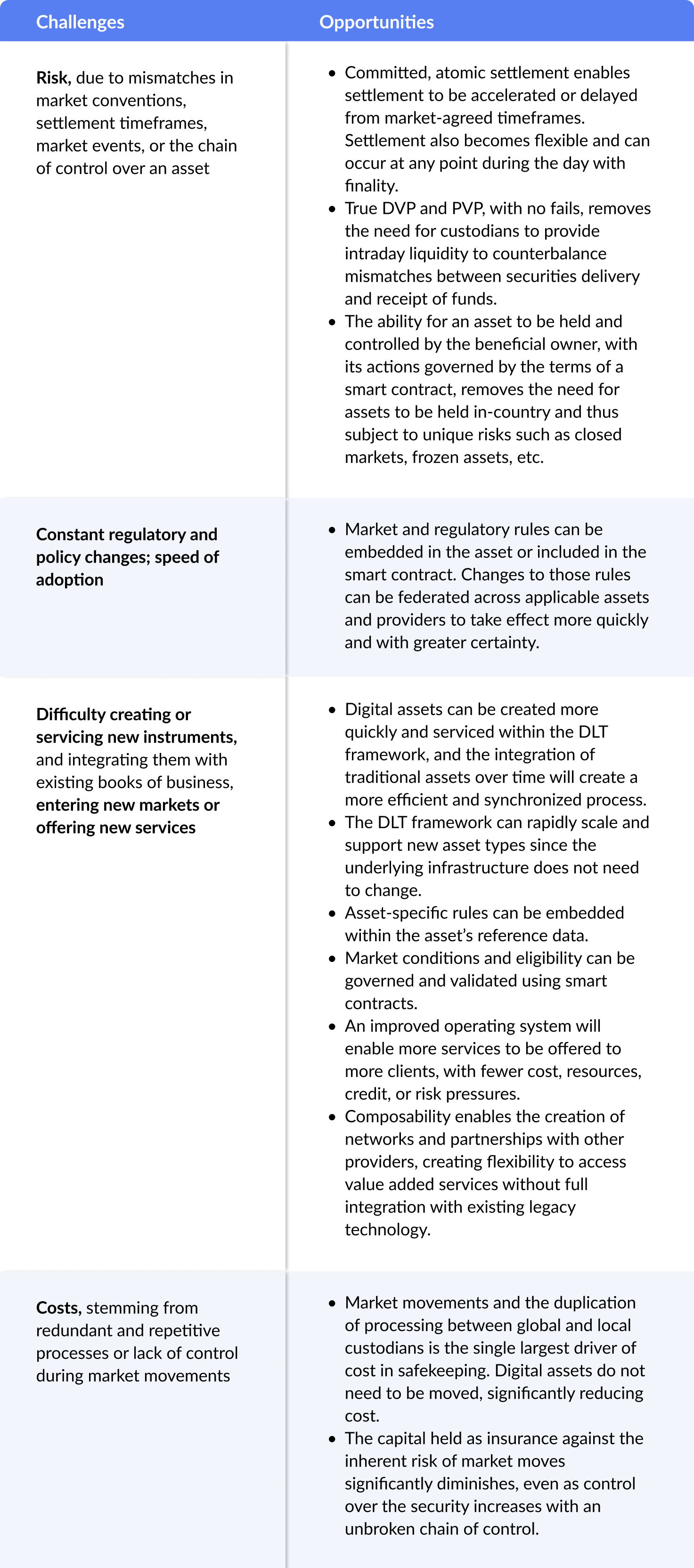

The combination of digital assets, smart contracts, and distributed ledger technology (DLT) creates the conditions for a revised operating system that can support these varied assets, address longstanding market challenges, and establish a framework for substantive change and opportunity.

Even at the most sophisticated providers, today’s operating processes run on a patchwork of domestic and global systems, which can range from a few to dozens. There are inherent limitations in safekeeping or moving assets seamlessly, resulting in assets that move in and out of control. Multiple cash and collateral accounts reside on different ledgers, making it difficult to deploy cash or collateral nimbly to meet obligations. And, with redundant technology across a global network of sub-custodians, data constantly needs to be reconciled, and gaps in systems and processes must be remediated manually.

Furthermore, competitive pressures and the need to sustain important client relationships result in custodians stepping in to support their clients in the period between trade and settlement date. They may advance funds prior to receipt of dividend or interest payments or provide intraday liquidity so that clients can use the proceeds of sales before settlement occurs. These services come at a price: Whether that is capital associated with safekeeping assets, with the cost and risk of cash advances or unsecured credit of intraday liquidity, or with operational expense and overhead from legacy operating processes.

The benefits of digitized, composable services

In a digital age, the operating process can function without these risks for the first time:

-

The safekeeper retains an unbroken chain of control over custody of the assets. When securities no longer go out of control between the global and local custodian, the corresponding liability, risk, and costs are eliminated.

-

Settlement cycles become more flexible, as committed settlement allows for shorter or longer settlement timeframes to be agreed between the parties, including the potential for intraday deliveries/payments.

-

The combination of committed and atomic settlement automates and guarantees the simultaneous delivery of securities and cash, so the custodian no longer needs to intermediate the payment or to bridge the gap by providing intraday liquidity and unsecured credit to support ongoing client activities.

The safekeeping relationship is perpetuated, as the global custodian gives the local custodian a delegated workflow over the digital process:

-

With digital ownership transfers, the asset doesn’t have to move. The safekeeper avoids penalties and liabilities in the event of a loss of assets. And, in the event of market crises, such as the cash crisis in Africa or the frozen markets of Arab Spring, the impact to investors declines, as assets are no longer held in the local market.

-

The capital costs associated with safekeeping assets will decline, benefiting all parties.

Investors and global custodians alike retain access to the critical local market knowledge and connections to the CSD and central bank provided by local custodians, who facilitate specific activities like tax reclaims, corporate actions, and adherence to local regulatory requirements.

Composable, digital services offer new flexibility for investors, who have more choice and more control, and safekeepers, who can deliver more services more easily:

-

Investors can combine, add, change, start, or end services as their asset and risk profile changes, giving them the power to better manage expenses and adapt to investment opportunities.

-

Safekeepers no longer have to offer everything themselves, but can join or create networks through which other providers can offer services on assets being held and moved digitally. This allows them to deliver solutions more quickly and efficiently, with less risk, broadening their potential client base.

Ultimately, the removal of core safekeeping risks and their related operating and capital charges creates opportunities for trading, liquidity, and the provision of new services.

The dawn of digitized safekeeping

Systemic shifts to safekeeping will largely be driven by upstream changes in issuance, clearing, and settlement. Custodians are already seeing changes as demand to safekeep digital assets rises (bringing new digital custody competitors) and the impracticality of sustaining different operating models becomes clear.

With a view to what’s on the horizon, Digital Asset has developed a range of solutions for custodians.

-

The extensibility and interoperability of Daml-based solutions allows custodians to solve specific issues and connect them to other solutions to derive greater benefit. For example, a solution that automates workflows and abstracts key management to eliminate operational risk could be connected to a solution that provides direct asset control with a single book of record for AUC and assets identified on-ledger in segregated accounts. Even if developed independently, a custodian’s future-state model could link these and other workflows to create a unified and digitized model of safekeeping that addresses the challenges outlined above, without the need to replace legacy systems.

-

To support custodians who use different safekeeping models, we have developed a library of reference applications. These can be used to address specific needs or jump-start a transition to an integrated and streamlined model that spans multiple markets and can support digital, tokenized, and traditional assets. As an example, our direct asset control reference application can kick-start development of a Daml-based custody and safekeeping solution. This enables direct control over client AUC with a single system of record, reducing the cost and risk associated with a bifurcated, global-to-local custodian model, and preserving the provision of local market expertise.

-

With modules for market setup, instruction receives/delivers, eligibility, settlement instruction, settlement, and reporting, the custodian can accelerate their ability to adapt and respond as safekeeping requirements shift. Further, this component-based approach facilitates the development of new, composable services and enables the creation of networks of providers, creating a new paradigm for safekeeping and post-trade services in the digital era of global investing.

“Distributed ledger technology (DLT) and Daml smart contracts create an opportunity for custodians to increase control over assets under custody in local markets. With a decentralised model, where trust is no longer placed in a single entity to carry out complex processes.”4 David Creer, Global DLT and Crypto Lead, GFT

Up next: Digital actions that improve corporate actions

Corporate actions have long been a pain point for post-trade, and the problem is sizable. In its 2020 Asset Servicing Innovation research, the ValueExchange established that around 70% of business units around the world were paying out over USD 2 million in corporate action errors. Data was identified as being the root cause of 56% of all corporate action errors.5

With reference data and lifecycle events embedded in digital assets, corporate actions (COAC) stand on the brink of substantive change. For the first time, it may be possible to solve the problem rather than to resolve the errors. Our next blog will explore how COAC processes can be standardized with end-to-end data transparency between issuers and investors, and how cross-entity data use can remove the need for—and the cost and risk of—repetitive, duplicative reconciliation.

Related reading

BIS, On the Future of Securities Settlement, March 2020

GFT and Digital Asset, Blockchain and Custodial Services, 2020

Standard Chartered, Bankable Insights, The Custodian Edition: Digitalizing Securities Services, December 2020

Citations

1GFT and Digital Asset, Blockchain and Custodial Services, 2020

2https://www.globalcustodian.com/custodians-assets-under-custody/, Q2 2022

3https://www.globenewswire.com/en/news-release/2022/06/29/2471383/0/en/Digital-Asset-Management-Market-is-projected-to-reach-USD-8-15-Billion-by-2030-growing-at-a-CAGR-of-18-Straits-Research.html#:~:text=The%20digital%20asset%20management%20market,period%20(2022%2D2030)

4GFT and Digital Asset, Blockchain and Custodial Services, 2020

5ValueExchange, Asset Servicing Innovation, 2020 and Corporate Actions 2021: What is the problem?

by Kelly Mathieson

October 3, 2022

by Kelly Mathieson

October 3, 2022

by Kelly Mathieson

October 3, 2022

by Kelly Mathieson

October 3, 2022

by Kelly Mathieson

October 3, 2022

by Kelly Mathieson

October 3, 2022