In a recent post, we introduced Daml Finance, Digital Asset’s solution for financial services firms seeking to accelerate and expand their use of tokenization. In this post, we’ll take a more detailed look at Daml Finance, including how it’s designed and how it works.

Why we built Daml Finance

Before we dig into the mechanics of Daml Finance, it’s worth reiterating why we built Daml Finance. Fundamentally, we wanted to solve many typical challenges and streamline the common processes involved with financial transactions. Our goal was to dramatically increase the efficiency of delivery teams—both our own customer experience development team and (more importantly) our customers’ teams. When developers can rely on proven elements to more quickly build meaningful applications and move them into production sooner, the overall time-to-value is shortened for stakeholders across the financial services ecosystem.

We also realized that tokenization solutions needed to be designed specifically for the needs of financial services firms. As we built out Daml Finance, we kept in mind a range of factors, from common transactions, to regulatory requirements and documentation needs, to the unique customer experiences that banks, insurers, wealth and asset managers, and other players in the industry are trying to deliver. Daml Finance is designed to effectively balance standardization and customization; it offers an extensive library of reusable components and building blocks and the ability to tailor offerings based on unique client needs and objectives.

The importance of asset compatibility and mobility

Given the existing challenges in tokenization, we knew we needed to solve for asset compatibility. The time-consuming and labor-intensive nature of translating assets across applications and systems has been a huge barrier to the adoption of tokenization by financial services firms. By creating a common foundational layer to represent any and all types of assets—from equities, to fixed income instruments, to complex derivatives, and everything in between—we allow our customers to build applications for almost any type of transaction or service; they don’t have to translate assets across different applications or systems. In fact, applications built on Daml Finance are inherently compatible with each other.

So how does it work in practice? Let’s say a firm wants to build a service based on bundled payments. With Daml Finance, it can immediately offer that service to all participants in the network that operate compatible applications. Another example: If a company were to create a pricing and risk service on top of Daml Finance, they could immediately offer that service to all customers, who could then integrate it within their own services and embed it within their apps.

Asset mobility is also key. Assets that are created in the context of one application can then move to different applications without any need for translation or integration. For example, a bond obtained in an issuance platform can be used as collateral in the context of a repo platform without any need to change the form of the asset. This is a big benefit, as the cross-application mobility increases the utility and liquidity of assets and, for example, paves the way for truly global collateral.

This mobility of assets results from a common asset model that sits underneath all Daml Finance applications and enables new, higher-level use cases to be built by composing other applications. It’s analogous to the ERC-20 standard in the decentralized finance space, where applications can be built on top of multiple other applications. For example, firms can build applications that optimize asset allocation across liquidity pools on top of applications that simply handle the allocation itself.

Asset programmability: The essence of tokenization

There is a prevalent misconception relative to tokenization and, in a similar sense, digital currencies. Tokenization is not exclusively about noncustodial ownership, or the presence of a token that can be sent to anyone in the world. The essence of tokenization is actually the programmability of assets. The representation of programmable assets on a programmable ledger, where multiple parties can interact with the asset, unlocks use cases that haven't been possible before (e.g., atomic delivery versus payment).

And to be clear, Daml Finance is focused on the needs of regulated financial services institutions. Rather than merely representing ownership of a simple decentralized asset, Daml Finance covers the full value chain of assets that are used globally in traditional financial markets today.

The same ideas apply to central bank digital currencies (CBDCs). Central bank money has been digital for a long time in the sense that it exists in databases, not on paper. But what makes CBDCs different and useful is the programmability of that money.

Daml Finance: Design principles and layers

To make the tokenization process as smooth as possible, Daml Finance embraces a few key design principles:

-

Asset representation should be as general as possible, so that it doesn’t limit transactions or applications into specific asset classes or types. Daml Finance allows you to represent most, if not all, of the regulated assets that financial services firms will want to bring onto their platforms.

-

Complex asset movements must be coordinated in a simple, intuitive way and the transactionality of underlying ledgers can be leveraged in an atomic way.

-

Frameworks need to capture the evolution of instruments and all of the events that occur during the lifetime of an asset. Agreed terms and conditions initially define how an asset evolves and what kind of cash flows and payouts it generates over time. But the potential for unexpected events and a range of contingent actions must also be accounted for.

Our approach: A comprehensive tokenization stack

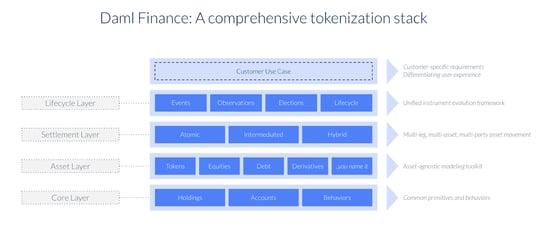

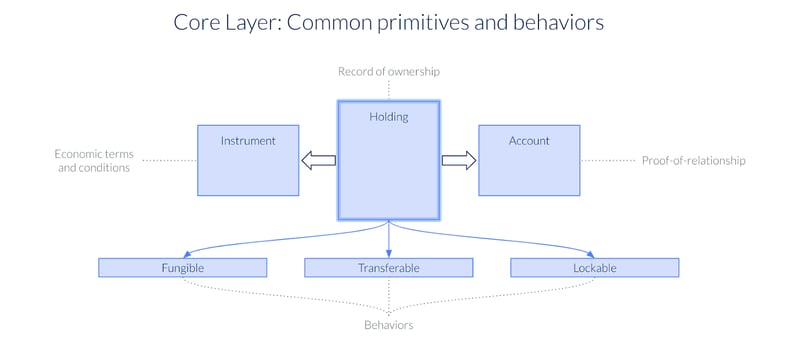

These principles are translated into the structure of Daml Finance via Layers. For example, the Core Layer shows ownership information—who owns how much of which assets and where they are held. Account information reinforces the validation that custodians must perform (e.g., not on sanctions list) within the universe of regulated markets. The Core Layer also ensures transferability and the ability to lock an asset to a party or immobilize it.

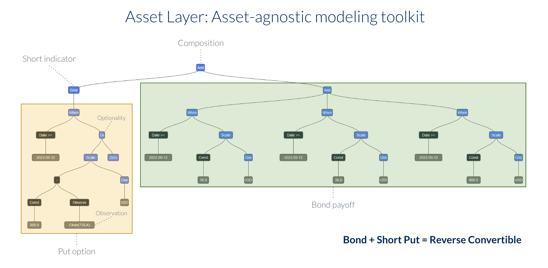

The Asset Layer includes the economic terms and conditions of financial contracts and describes the semantics and behaviors of financial instruments (e.g., cash flows due on a certain date). The Asset Layer is asset-agnostic—that is, it can be used for any type of asset.

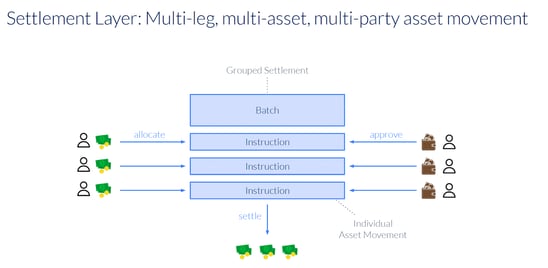

The Settlement Layer supports all legs of these transactions and works in multiple directions. Critically, it can handle multiple assets involving multiple parties and perform intermediated settlement across a chain of custodians. It’s also designed to support hybrid settlement models, where one leg of a transaction happens off-ledger, such as a delivery-versus-payment settlement, where the security moves on ledger and the cash leg is settled off-ledger, for example through SWIFT.

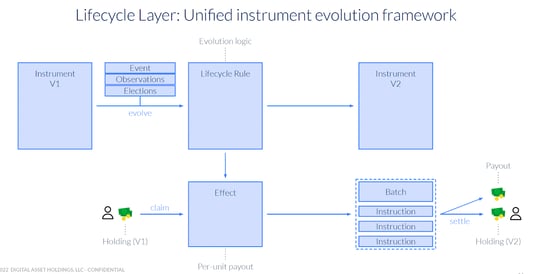

Lastly, the Lifecycle Layer provides a uniform workflow to handle known, contractual events on instruments (like interest payments on a bond), as well as unknown, external events (like a dividend payment on a stock, or a default event on a bond). The flexible design also supports events like elections on options and other events where asset holders or issuers can make choices on their instrument.

Again, the reusable components within each of these Layers make it easier for developers to create many different types of assets and instruments. Most importantly, those components enable developers to focus on the delivery of a particular customer use case.

We are proud to have launched the first and only purpose-built, end-to-end asset tokenization toolkit on the market today. We are even happier that many of our customers are using Daml Finance to develop innovative and differentiating solutions and experiences and get them to market faster than ever before. Thanks to Daml Finance’s flexibility, those solutions are diverse, from tokenization of gold, to green bonds, to complex commodity trades and carbon exchanges, to insurance policy administration and securities lending.

If you’d like to schedule a demo or talk to us about how Daml Finance can help with your unique business use case, please get in touch. You can also explore the Daml Finance documentation or watch the latest webinar.

by Georg Schneider

January 25, 2023

by Georg Schneider

January 25, 2023

by Georg Schneider

January 25, 2023

by Georg Schneider

January 25, 2023

by Georg Schneider

January 25, 2023

by Georg Schneider

January 25, 2023