Blockchain applications are gaining traction in regulated financial markets because of their potential to drive innovation, reduce risk, and decrease process costs and inefficiency. The boldest and most forward-looking firms are going beyond these baseline benefits to create new revenue streams by tokenizing the full asset management lifecycle.

This two-part blog series will explore the value of tokenization and how to get started, and will introduce Daml Finance as the right solution for enterprises seeking to accelerate and expand their use of tokenization. I will also highlight compelling use cases, demonstrating how tokenization can spark growth by making it easier for enterprises looking to launch new services and engage partners in new ways—like via new ecosystems and platforms for trading, transaction processing, data exchange, and more. I will share some real world examples in production further down.

A purpose-built asset tokenization toolkit

Digital Asset announced the launch of Daml Finance at Sibos 2022, which packages best-in-breed libraries from proven financial workflows to help customers accelerate their tokenization initiatives. Daml Finance leverages standard approaches in tokenizing regulated financial assets on a blockchain by providing the libraries, tools, and guidance needed to develop complex financial applications in a fraction of the time.

My colleague Valeria Zafar and I explain how Daml Finance works and how it’s purpose-built to accelerate tokenization and lifecycle management of complex financial instruments. Hear more in our interview from the launch at Sibos 2022.

What are the potential challenges of tokenization?

To realize the benefits of tokenization, financial services firms need to develop core capabilities, including the ability to create efficient infrastructure and develop new applications. But for most firms, it can take years to build out the foundation for proprietary tokenization solutions, depending on the use case. Blockchain platforms such as Ethereum provide token standards like ERC-20, which enables tokenization for the exchange of fungible tokens. This is a small part of a comprehensive tokenization platform.

Other, similar solutions only cover a single vertical/asset type, which doesn’t scale across the diverse product landscape of traditional regulated assets. These solutions that only tokenize asset ownership are solving for but a small part of the value proposition of digital assets. Daml Finance is the only one that covers the full value chain of regulated assets, and does so across the full spectrum of different assets.

How do I know if tokenization is right for my business?

Tokenization can help address the dynamic nature of trading, ensuring that all parties have access to the same information as that information and trade conditions changes. It can also solve the challenges of the settlement process. While the value proposition of tokenization is clear, financial services firms are challenged to move forward because of the many moving parts to manage. Daml Finance provides the core functionality necessary to unlock the full potential of tokenized assets.

Specifically, it addresses three core requirements:

-

A powerful trade representation that is cross-asset, multi-purpose, and process-oriented, allowing for uniform processing of financial workflows

-

A trade evolution framework that captures and automates the logic for straight-through processing across the entire lifecycle, including complex events

-

A flexible settlement model that allows for coordination and execution of complex asset movements with more efficiency and less risk

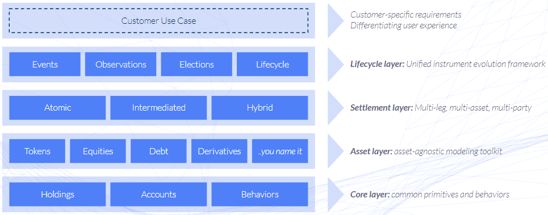

Daml Finance combines these exact properties into a comprehensive tokenization stack.

Daml Finance is a toolkit that offers a standardized library of assets to help optimize how digitally native assets are created, issued, traded, and retired. Daml Finance supports many different use cases and asset classes, including equities (stocks), fixed income (bonds), green bonds, structured products, private equity, commodities, complex derivatives, carbon credits, and central bank digital currencies (CBDCs). It comes with starter kits of specific use cases and off-the-shelf extensions for unique assets to make it easier to model the complete lifecycle of regulated and complex financial products—from approval workflows and term sheet creation, to allocation, issuance, and settlement.

But we understand that operating models don’t change overnight, and it’s best to minimize disruption as they update current processes and practices. Daml Finance is designed with those realities in mind:

-

The modular library allows enterprises to pick and choose the functionalities they need for their particular use cases. If they want to perform lifecycle management off-ledger through existing systems, they can simply choose not to deploy this functionality from Daml Finance.

-

Our settlement framework supports hybrid ways of settling transactions. For example, the cash leg or a delivery-versus-payment (DVP) transaction can be executed through traditional rails (e.g., SWIFT), with only the asset leg executed on the ledger. Of course, this removes the atomicity from the transaction, but it is supported in the same way as full, on-ledger settlement.

Tokenization in the real world: High-impact use cases

There’s a lot banks, asset managers, investment firms, and insurance companies can do once they establish strong tokenization capabilities. Transforming issuance, settlement, and other core processes leads to faster matching of buyers and sellers and quicker settlements. Tokenization also increases liquidity, including for private securities. Firms can also expand investor access to digital assets, including more classes of equities, commodities, and real estate. Finally, tokenization promises both greater transparency and stronger security.

Further, building new solutions on a common foundation allows financial institutions to develop their own platforms for engaging individual clients or a community of partners. These network effects are based on connectivity with other Daml-based platforms, providing access to an extended customer base and complementary services to grow ecosystems and business.

Services built on Daml Finance can be shared and deployed across all compatible ecosystems. Assets originated in one application can be seamlessly used in another, and applications can be composed to provide higher-level workflows and functionality. These standardized elements enable financial services to customize their specific user cases based upon their unique requirements and the target user experience they’re aiming to offer.

Crucially, these are not theoretical applications. Daml is already being used by customers across financial services, including Clearstream, a major European international central securities depository (CSD) owned by Deutsche Börse AG. Jens Hachmeister, Head of Issuer Services & New Digital Markets at Clearstream, said about the launch: “For us as a provider of financial market infrastructure, collaboration and leveraging cutting-edge technology is key for reaching the next step in digitizing our industry. We welcome the newest addition of Daml Finance to Digital Asset and are excited to continue to jointly drive tokenization in financial services.”

We’ve seen many users who start with a single asset class, like bonds, and put the full asset value chain (origination, issuance, distribution, servicing, and trading) on the ledger. These processes are built in an asset-agnostic way, so that new asset types can be added quickly using those same processes.

With that in mind, we’ve built out Daml Finance based on the experiences of leading organizations across a range of business functions and process contexts:

-

Paramutuel betting platforms

-

Gold tokenization

-

Green bonds tokenization

-

Natural gas exchange

-

Carbon exchange

-

Insurance policy administration

-

Securities lending

-

Syndicated bond issuance

-

Digital currency exchanges and crypto spot trading

-

Cross-border payments and central banking digital currencies

For exchanges, banks, and other organizations seeking to build out blockchain platforms and applications and tokenize traditional assets or create new digital assets, the bottom line is realizing a much faster time-to-market and the freedom to focus on developing rich, differentiated solutions and experiences, based on the strengths of core, open source assets.

Daml Finance is the only purpose-built, end-to-end asset tokenization toolkit on the market today. With Daml Finance’s extensive asset modeling capabilities, users can fast-track development efforts, creating new revenue channels by getting these solutions to market faster. It gives financial institutions everything they need to accelerate innovation and the development of financial applications.

Stay tuned for a second post that more deeply explores current challenges across global markets and allows us to explore in greater detail how Daml Finance is helping financial institutions and other firms overcome them. In the meantime, check out our recent Daml Finance webinar below.

by Georg Schneider

November 8, 2022

by Georg Schneider

November 8, 2022

by Georg Schneider

November 8, 2022

by Georg Schneider

November 8, 2022

by Georg Schneider

November 8, 2022

by Georg Schneider

November 8, 2022