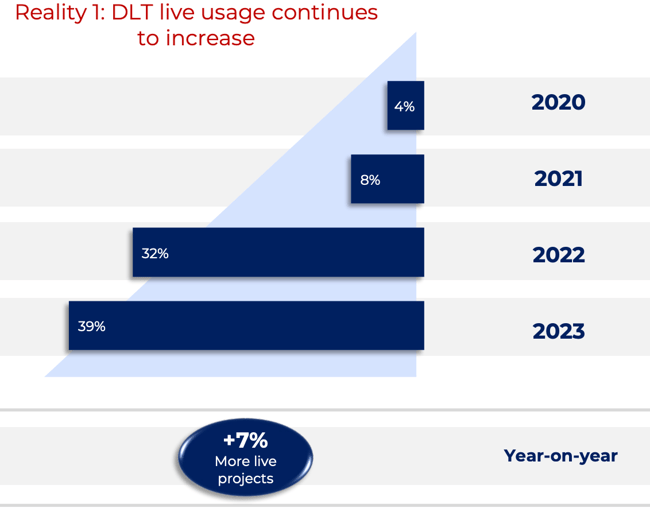

What are the core principles traditional financial services (TradFi) firms should consider when selecting blockchain technologies and networks? The most recent data shows that 39% of blockchain projects across capital markets are now live, a 7% increase year on year¹. But why has adoption been slower than many once expected? What can TradFi firms learn from these early successes to deliver on the blockchain promise?

In a recent webinar hosted by Digital Asset, Chief Product Officer Bernhard Elsner and Dharmendra Kapadia, Associate Director of Equilend 1Source, delved into these and related questions. The session raised a number of critical questions for any firm seeking to use blockchain and distributed ledger technology (DLT) to unlock significant business value. And it demonstrated the advantages of the new Canton Network—a first-of-its-kind solution to the primary barriers that have slowed blockchain adoption in financial services.

Source: “DLT in the Real World 2023” report, p. 5, The ValueExchange

Why TradFi needs blockchain

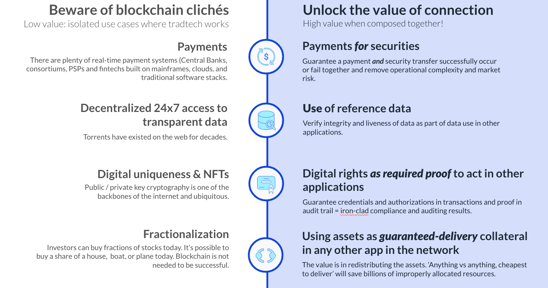

Blockchain offers unique value propositions for financial services. One of the ultimate promises is reconciliation-free business: With blockchain, there is transformational potential to reduce operational and capital costs across complex, multi-party workflows. Where conventional tech solutions fall short, blockchain can enable next-generation process automation and facilitate seamless coordination of workflows across independent institutions and applications in real-time.

Second, composability and application interoperability change how value moves across different platforms, unlocking new opportunities. Integrating emerging digital securities issuance platforms with securities lending marketplaces increases the utility and liquidity of digital assets. The potential of connecting digitalized, programmable cash with the lifecycle of digital assets creates exciting ways to transform settlement and reduce risks across financial markets.

The business case for blockchain in TradFi is persuasive. So what is currently holding players back from unlocking its full value?

Until now, financial organizations have had to compare the trade-offs between public and private blockchain networks. Public networks sacrifice privacy and control, while private networks struggle with interoperability among independent deployments. This creates a dilemma for traditional finance players that want to define their own controls and maintain privacy but also benefit from the network effects that come with native interoperability.

So is there a way forward? Yes, by solving the three imperatives of sovereignty, privacy, and composability.

Sovereignty: Decentralization while maintaining control

While privacy and interoperability make more headlines in the blockchain space, sovereignty is often the key consideration when institutions are evaluating whether a blockchain will meet their needs. In this context, sovereignty means control over your application, who can join, and the SLAs you can promise to network participants. It also means that as a participant you have complete control over your data, how it is used, who can see what, and where it is stored.

“We had to convince people that sovereignty was something we took very seriously,” said Dharmendra Kapadia, Associate Director of EquiLend 1Source. Simply put, TradFi simply cannot give up sovereignty.

In public blockchain networks, sovereignty over how applications are run is one of the trade-offs. Each application ultimately has to deploy to a single monolithic blockchain and accept its governance. To solve this, private blockchains sprung up, but as time has passed this inspired the creation of many centrally controlled private islands—where interoperability across these islands has not proven possible in a secure, scalable way, greatly limiting the range of potential use cases.

Privacy: The future challenge of the ecosystem

Privacy is the most pressing challenge in the blockchain space and is crucial for scaling the ecosystem. “Privacy between the individual participants is paramount. That is something that was essential in our investigation of blockchain,” said Kapadia. For EquiLend, Digital Asset’s Daml and the Canton blockchain protocol proved to be the right technology to meet these privacy demands as it built 1Source to provide a single source of truth for the securities lending industry.

For blockchain privacy to really work, it must guarantee that only approved parties can access, view, store, or modify data. Application operators and users need the fine-grained controls to deliver the right level of privacy, at the right time. Because it is such a hot-button subject, public chains and Layer 2 solutions have built compelling narratives, but often mislead on their ability to maintain a high standard of privacy. Under the hood, the privacy models of Enterprise Blockchain platforms have turned out to not be as enterprise grade as once promised. Privacy should not be looked at in isolation either. If gaining privacy comes at the expense of off-ledger workarounds, or interoperability trade-offs then something is not right.

Composability: The need for connection

The value multipliers of blockchain are unlocked when it’s possible to compose multiple applications together across the value chain. “If you want to leverage the power of blockchain and DLTs, you have to think about how they can seamlessly talk together,” said Kapadia. Composability, and interoperability more generally, are essential for avoiding settlement and liquidity risk.

But speakers argued that current interoperability solutions—like asset bridges, message bridges and cross-chain settlements—are bandaids for composability and often introduce more risk than rewards.

Introducing the Canton Network: A new network of networks built for finance

The Canton Network offers both private and globally available network infrastructure, enabling a new way to achieve application interoperability and composability, while still maintaining the data privacy and sovereignty financial institutions require. Canton’s aim is to facilitate the organic growth of a ‘network of networks’ that gives institutions the right balance of sovereignty, privacy, and composability, taking inspiration from the most successful network the world has ever seen—the Internet.

Applications running on Canton are natively interoperable. They can operate on private infrastructure, or they can use common Canton infrastructure and rules to compose workflows with other Daml applications. This allows users in the network to construct transactions that span across applications where all legs must be valid for the entire transaction to succeed. There is no risk of one component of a transaction succeeding while another part fails.

“Canton will take care of decentralization but still maintain sovereignty, privacy, and all of the other features that we require to enable smart contracts across securities lending,” said Kapadia. “It will make a huge difference for us.”

Final thoughts

Adoption of blockchain technology is accelerating, but to realize maximum value, TradFi institutions need to consider the imperatives. Without the right approach to blockchain, users won’t see the full benefits. The Canton Network is here, underpinned by Digital Asset's Daml technology—and with the recent release of TestNet, the group of organizations already helping to bring the Canton Network to market have demonstrated that the data integration and governance mechanisms at the heart of the infrastructure are sound and functioning effectively. For the remainder of 2023, participants and applications using this new infrastructure continue to grow ahead of MainNet availability in 2024.

Nine out of the 10 leading global investment banks are already participating in applications that use Daml and Canton. These organizations and others using this technology arrange more than 50% of the world's syndicated loans. $1.4 trillion in repo transactions a month are made using the Canton Network’s underlying technology: The smart contract platform Daml, and its embedded blockchain protocol, Canton.

For a deeper dive into sovereignty, privacy, and composability and their real-world blockchain applications, watch the full webinar. To learn more about the Canton Network and how it is addressing key considerations for regulated financial institutions, visit here.

¹https://thevx.io/campaign/dlt-in-the-real-world-2023/?utm_medium=email&_hsmi=266930789&_hsenc=p2ANqtz--4-X2zn0k2ydFk2bWbe1GrKO15QhD2usCQgMEUkJRjQ1tYaEzj-AeO5jMYHERjSDC2twyrckjxuyzLkcF7U2QXl8ubqoaJc9NEF0jkaXiN377Xi-c&utm_content=266930789&utm_source=hs_email