Untying the Knots: How DLT and Daml Can Transform Corporate Actions

In collaboration with IntellectEU, we explored numerous ways distributed ledger technology (DLT) and Daml can transform securities services, including clearing and settlement, KYC processes, corporate actions and more. Through a series of blogs we are sharing our analysis, highlighting what DLT and Daml can do for you today.

Corporate actions processing has plagued capital markets for decades with high levels of inefficiency and risk. While great strides have been made to improve straight through processing in other areas of the investment ecosystem, corporate actions have been left behind as too difficult to automate with its complex chain of communications, multiple touchpoints, and lack of structured data at the source. It’s also a place where IT spending offers little tangible return on investment. All of this has left issuers and investors grappling with how to best communicate and capture that golden source of truth.

What is a corporate action and why should I care?

A corporate action is any activity from a publicly-traded company that brings material change to an organization and impacts its stakeholders. Corporate actions include stock splits, dividends, mergers and acquisitions, rights issues and spin-offs. All of these are major decisions that typically need to be approved by the company's board of directors and authorized by its shareholders. A corporate action notification error can be catastrophic to a company and its shareholders. Processing failures can arise anywhere in the corporate action chain, and all market participants run the risk of failures. A simple mistyped data input at any point in the process could result in significant financial losses to both the company and the shareholder.

Traditional processing of corporate actions is costly and complex

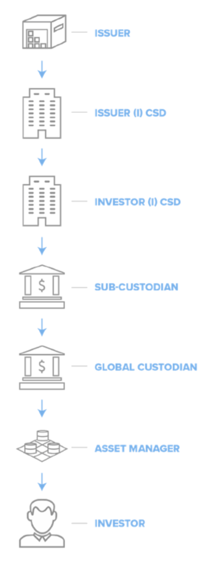

Corporate actions demand accurate event details to be received in a timely manner with accurate (fully reconciled) holding records to ascertain a controlled and risk-free processing in current holding chains (the chain of “custody” service providers).

Even the simplest corporate action can be a challenge from a processing perspective. What increases cost and complexities further is that processing has to be performed and executed at each step of the holding chain. This results in a global cascaded process from the issuer (and its agent) to the investors (or bottom-up when processing investors’ elections).

Processing also takes time, generally spanning three main steps performed at predefined dates or periods:

- Information dissemination / collection (including eligibility assessment)

- Eligible balance determination and entitlement calculation

- Corporate action processing (including investors’ instructions processing, execution of cash and securities movements) and respective confirmation

All of the complexities described above often result in delayed notification, incomplete or inaccurate data quality, and conservative election deadlines. In addition, traditional processing of corporate actions heightens operational risks, which worsen with the length of the holding chain.

How to move corporate actions processing to a distributed ledger powered by Daml smart contracts

It’s worth noting that Daml fits particularly well within the implementation of corporate action workflows.

Why? Because, Daml is specifically designed to develop smart contracts supporting the performance of the rights and obligations defining the corporate action. As such, the language facilitates a clear definition of the involved stakeholders and role enforcement.

A Daml corporate actions application implements a single place of processing built on a “corporate action” distributed ledger. It involves two main workflows:

- Set-up the corporate action as a shared record (“the golden record”): The corporate action creates rights and obligations - for the issuer, investors and/or offeror - described in binding legal documents. In essence, this establishes a “data-driven” process in place of the current “document-driven” process (as most of the corporate actions combine known and standard features that are easy to parameterize). The key data/parameters defining the corporate action can then be used to generate the related legal documentation.

- Perform the entitlement calculation, simultaneously throughout the holding chain. This calculation will be performed according to the same principles used in “simultaneous settlement”, a Daml workflow that atomically settles inbound and outbound cash and securities movements (you can read more about simultaneous settlement in a separate blog on the topic here).

By implementing the first workflow on a distributed ledger, all the stakeholders involved in the set-up of a corporate action (e.g. issuer, agencies, lawyers, central securities depository, investment banks) will be able to contribute to the shared record as per responsibilities. This shared record will be instantly available to the market participants, while the liability of each stakeholder will be clear as all contributions will be traced in the DLT immutable audit. Beyond process simplification and risk mitigation, market participants will have the advantage to instantly access the information whether it is preliminary, incomplete, or complete and confirmed. The ability to have earlier access to corporate action information might be crucial for investors.

Similarly, the entitlement calculation workflow provides a number of cost and risk-mitigation benefits. It effectively relieves the intermediaries from calculating the entitlement themselves and implements a one-place processing for the corporate action. In case of elective corporate action, the beneficial owner instruction will be made in direct interaction with the corporate action processing workflow. On the payment/effective date, the asset movements will be performed using the “simultaneous settlement” mechanism. Investors will be immediately aware of the corporate action processing completion as the DLT makes the process progress fully transparent to all authorized stakeholders.

To learn more about what DLT and Daml can do to improve corporate actions processing, download the IntellectEU and Digital Asset e-book today.

Download the “Digitally Transforming Securities Services” e-book by Digital Asset and IntellectEU on DLT, smart contracts and their practical applications in the Financial Services Industry, from account onboarding to post-settlement and treasury services.