Building the business case for asset tokenization and understanding the journey for capital markets

The ValueExchange, in partnership with and sponsored by Digital Asset, conducted extensive interviews with leading exchanges, depositories, brokers, custodians, and service providers to describe the collective capital market experience of deploying digital assets in greater quantities. This report showcases the lessons learned by industry leaders on the role of tokenization in capital markets, as well as explains the path towards a successfully tokenized future. Click here to access the full report.

Asset tokenization lays the foundation for future innovation while enabling a complete and digital transformation of capital markets today

Capital markets are reaching a critical juncture, as the manual processes and legacy systems that underpin today’s transactions and communications are not sustainable for the innovation that must take place in years to come. These dated—yet critical—technology systems increase costs and risk, while stifling the innovation that must take place for enterprise financial services to remain competitive. According to the ValueExchange’s three years of cumulative market research and the analysis conducted in the Doing Tokenisation Right report:

-

It takes six weeks and over 100 people to issue a bond

-

2,000 manual tasks need to be completed in every bond issuance

-

The average trade runs through seven systems, each reconciling with each other on a daily or even hourly basis

-

There is almost no market system handling both cash and securities today

-

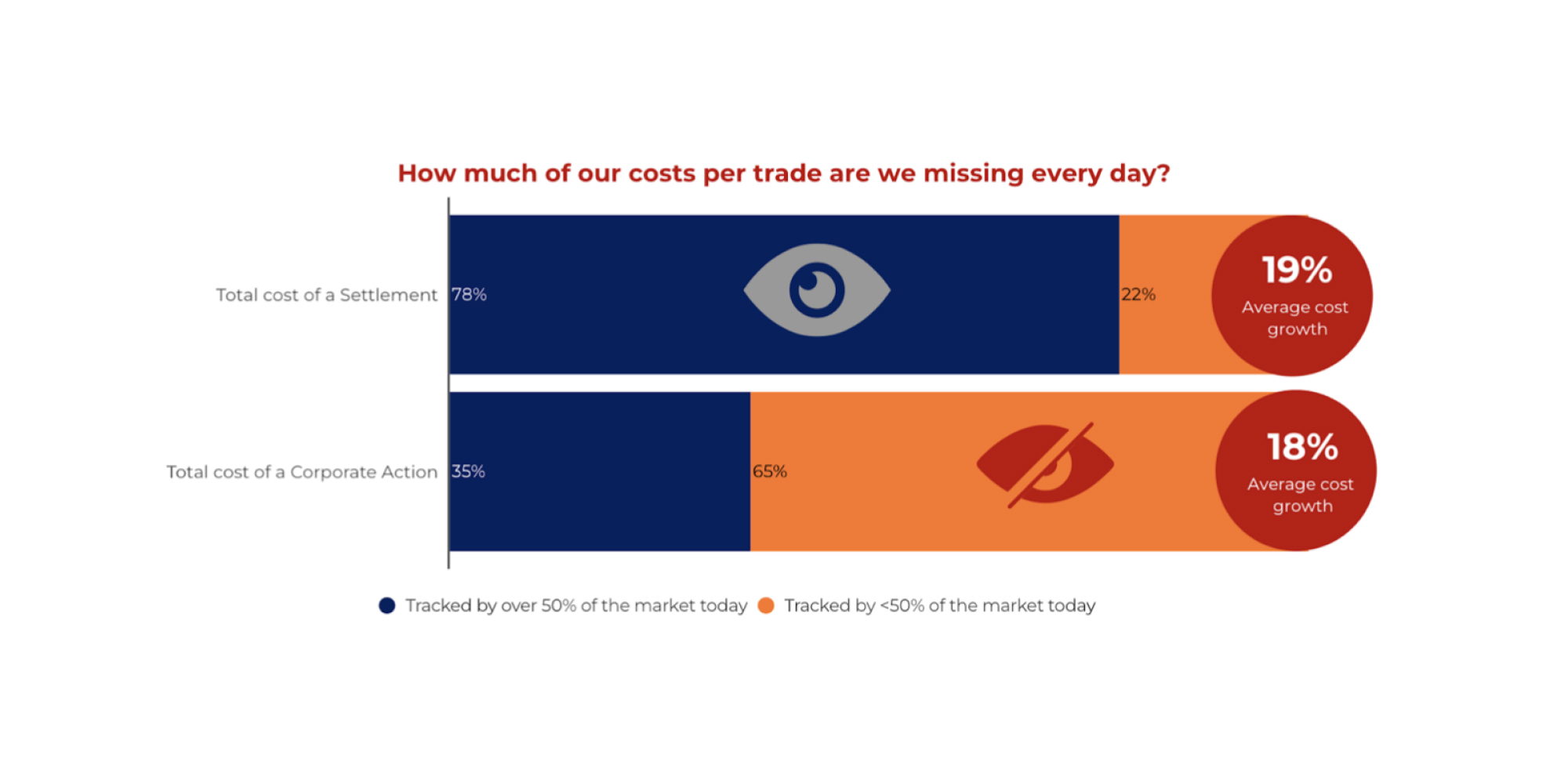

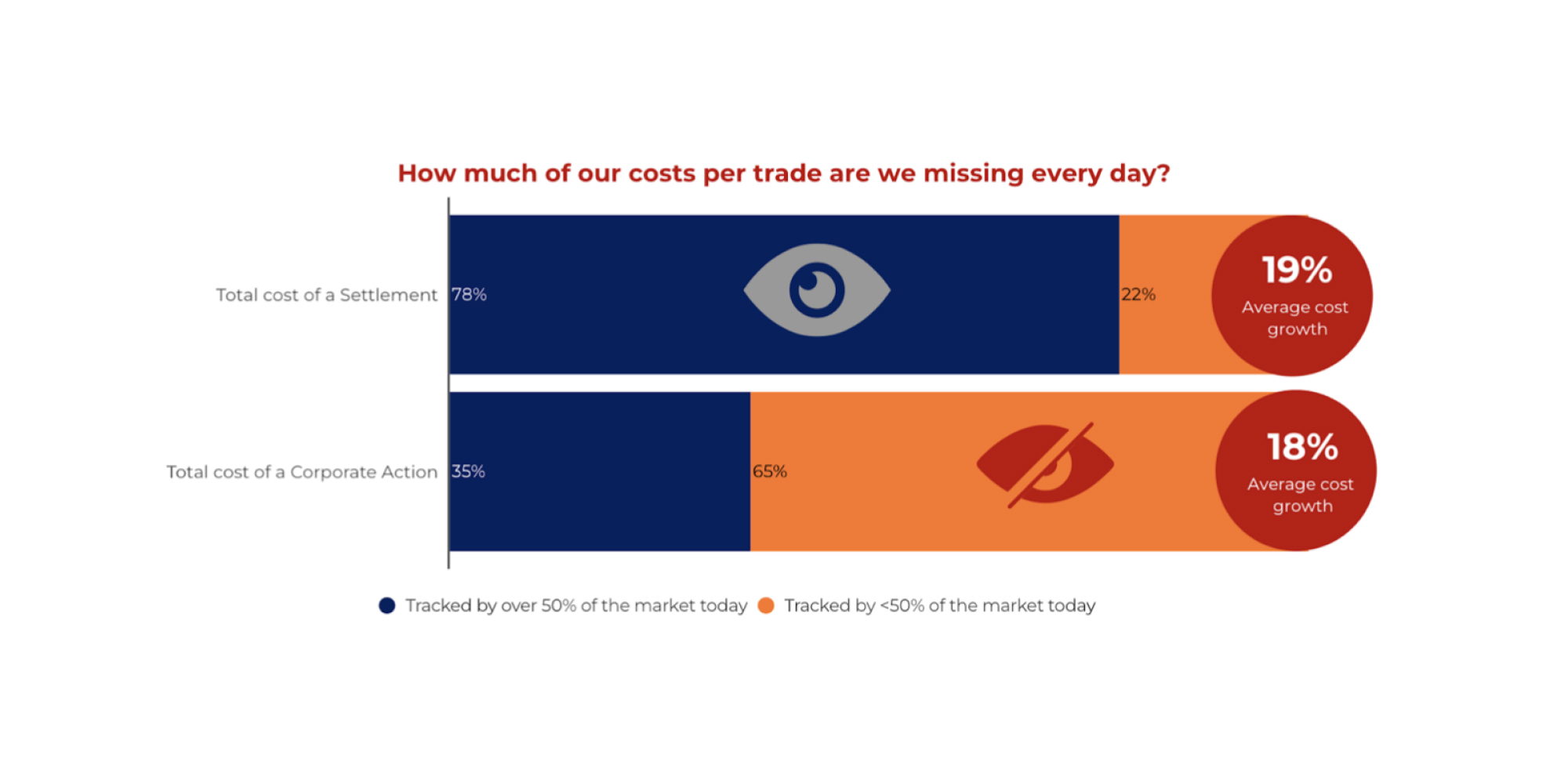

5-10% of our trades fail every day—creating daily error queues of over 10,000 failing trades

-

The costs of a settlement are rising by 14% year on year—driven most of all by the growing cost of human resources

-

Corporate action errors cost 70% of the market over USD $2m per annum

-

It takes 25 days for a dividend to pass from issuer to the end investor

As more market players embrace distributed ledgers, they are able to transform historically complex, often siloed processes without disrupting operations by tackling specific areas of the business and creating a foundation upon which innovation can take place.

Asset tokenization, through the use of distributed ledgers, fundamentally changes the access model for assets, by providing programmatic access to and control of the asset itself, opening up the possibility to weave asset movements directly into workflows and business processes. The concept of tokenized assets enables operational efficiency by defining the entire lifecycle of the asset itself, ensuring power trade representation that is cross-asset, multi-purpose, and process-oriented. However, as businesses embark on the journey toward asset tokenization, they must understand 1) the business case and 2) the potential obstacles that may take place on the journey forward.

The evolving case for asset tokenization

Issuers, intermediaries, and investors each benefit from the innovations of tokenization. The following drivers are critical for businesses as they build the business case for asset tokenization investment:

-

Issuer key business drivers

-

Accelerated information relay and reduced settlement risk

-

Intraday product design and balance-sheet benefits of real-time pricing

-

Golden source of information that is more than data management; from investor visibility to investor management

-

Stepping out of the security lifecycle

-

Intermediary key business drivers

-

Lower operating costs: Moving beyond trade fails and reconciliations

-

Balance sheet savings today to mobilizing the balance sheet tomorrow

-

Crypto and cash convergence

-

Investor key business drivers

-

Greater yield through increased performance and lower cost

-

Ability to drive liquidity and transferability in fund trading

-

Improved trade execution

-

Moving from passive valuations to active data-driven management

The journey toward doing asset tokenization right

As businesses prepare and invest in tokenization solutions, learning from early adopters will not only ensure a more efficient transformation journey, but also help provide a successful delivery. From preparing the path to execution and platform design, the ValueExchange gathered insights from the world’s largest financial institutions to outline an effective industry roadmap for rapid innovation in the future.

Tokenization enables businesses to reduce risk, drive cost efficiencies, and improve returns for investors across the world

“If one learning point stands out above all others in the tokenization journey, it is that solution definition and preparation is key. We have seen unfortunate examples of firms eager to begin a technology build without first having taken the time to define the need, the ecosystem, and the target operating model fully—but the due diligence in this first phase is the difference between success and failure in our tokenization projects.”

-Kelly Mathieson, Chief Client Experience Officer, Digital Asset

“We have to change our mindset around what we want to achieve with digital assets. The tendency today is to focus on building an app to replace an existing app. Tokenization doesn’t mean just digitisation—it means changing our business processes in order to expand and connect our app to a bigger ecosystem. It’s about focusing on core competencies and acknowledging that I’m not the captain of every piece of the process in a walled garden anymore. Instead, I am becoming the master of my application within a much bigger ecosystem.”

-Eric Saraniecki, Co-Founder and Head of Strategic Initiatives, Digital Asset

At Digital Asset, we have created a smart contract framework called Daml, and a privacy-enabled blockchain called Canton, which are both built with the demanding requirements of financial use cases in mind. With Daml and Canton, we can bring nearly the entire lifecycle of an asset or a workflow on-chain—not simply each participant’s position represented by a bearer token. We can codify the expected and allowed behaviors of assets and processes into smart contracts and ensure policy compliance. Daml Finance is an expansion of our smart contract platform that accelerates the tokenization process. Learn more about Daml Finance here.

This new, open-source offering within Daml provides users with a collection of purpose-built libraries to enable rapid development of enterprise-grade tokenization solutions. Daml Finance provides financial institutions with the tools needed to accelerate the innovation cycle, shorten time-to-market, and build with proven libraries purpose-built for financial workflows.

We’re taking a unique approach by modeling the entire lifecycle of the asset. Daml Finance is the only tool currently available that can model complex use cases with full composability and settlement finality. These libraries are being used by global financial institutions to create more robust, extensible tokenization solutions across a wide spectrum of asset classes.

Our customers who build their tokenization applications via this common foundation are able to create networks with other Daml-based platforms. We believe this will open up new networks of value for customers to grow enterprise ecosystems—all with strong privacy built in.

by Eric Saraniecki, Co-Founder & Head of Network Strategy, Digital Asset

October 31, 2022

by Eric Saraniecki, Co-Founder & Head of Network Strategy, Digital Asset

October 31, 2022

by Eric Saraniecki, Co-Founder & Head of Network Strategy, Digital Asset

October 31, 2022

by Eric Saraniecki, Co-Founder & Head of Network Strategy, Digital Asset

October 31, 2022