Broadridge Smart Contracts and Distributed Ledger Technology

On June 14, Broadridge Financial Solutions announced it went live with its Distributed Ledger Repo platform, averaging daily volumes of over $31 billion in repurchase (repo) transactions. Powered by Daml’s application framework and VMware Blockchain’s distributed ledger technology, this solution not only creates better and more efficient repo transactions but also—and more importantly—sets the stage to transform this critical market for the first time in nearly 30 years.

For a 360° view of the reimagined repo process, from impetus to impact, we sat down with experts from Broadridge, Digital Asset, and VMware Blockchain.

- Horacio Barakat, Head of Digital Innovation for Capital Markets, Head of DLT Repo Platform, Broadridge

- Kelly MathiesonChief Client Experience Officer, Digital Asset

- Tanya ShastriVice President of Products, Blockchain, VMware

Repo transactions are open-ended and complex multi-party transactions with daily lifecycle events including collateral valuation and exchange. Each participating institution can have different reasons for engaging in a repo transaction, which means different functionality requirements. Furthermore, each institution uses its own systems to process and manage the transactions.

Today’s repo market is safer thanks to post-crisis reforms but remains full of operationally intensive, customized processes. Manual reconciliation and intervention result in significant operational overhead and capital utilization due to asynchronous cash and securities settlement. With no single source of truth for the lifecycle of the trade, fragmentation, fails, and disputes are common and costly.

Outdated technology, where each party has its own siloed systems, makes repo the perfect candidate for technological transformation using Blockchain or Distributed Ledger Technology, as it breaks down data silos and creates a shared, trusted source of truth, says Tanya Shastri at VMware.

According to Horacio Barakat at Broadridge, “Broadridge envisions a fully-automated end-to-end repo service that supports the simultaneous settlement of cash and securities, removing risk from the process and significantly decreasing capital costs.”

The difficulty of this should not be underestimated given the size, speed, and systemic importance of these markets. The $10 trillion repo markets include intraday, overnight, and term repos, both bilateral and on an intracompany basis. As Kelly Mathieson of Digital Asset notes, “The repo markets are the workhorse of finance. They underpin the smooth functioning of the capital markets by providing essential financing and liquidity to global corporations and local municipalities.” Shastri agrees, “Given the significance of the repo markets, it’s important to deliver this innovative technology while also making it extremely robust – with the highest levels of data integrity, availability and security.”

Why now?

Until recently, the right technologies were not available to effect wholesale modernization, which would need to be undertaken by a neutral party or industry group since no one participant can or should effect broad-based change. While several industry initiatives are tackling specific problems, no one was looking at a fundamental shift. “The repo markets are very efficient, but we were convinced that they could be made more effective, both operationally and in terms of cost,” noted Barakat. This means tackling both the challenges and inherent risk of a large and complex market with numerous participating institutions.

Technical innovation in Blockchain or Distributed Ledger Technology (DLT) has enabled broad scale transformation. According to Shastri, “Through a combination of consensus and cryptographic techniques, the blockchain network can be trusted as a single source of truth even in the presence of malicious activity.” This removes the need for data reconciliation, reduces errors and improves auditability.

Smart contracts running on a blockchain network allow multiple parties to have shared business processes that can be standardized and automated. The blockchain network enforces these business processes, significantly reducing business risk, and creating value for the entire multi-party network.

The combination of Broadridge, Digital Asset, and VMware Blockchain is uniquely suited to reimagine and revolutionize the repo markets.

- A key market infrastructure provider, Broadridge supports 19 of the 24 primary dealers. As a trusted industry partner, they have a deep understanding of how

repos are structured, used, and executed, plus the connections to facilitate the implementation of an enhanced model.

repos are structured, used, and executed, plus the connections to facilitate the implementation of an enhanced model.

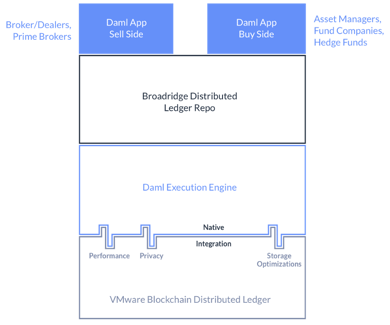

- Daml contributes both extensive capital markets expertise and innovative technology. Daml’s application framework defines and creates efficient multiparty workflows; uses smart contracts that embed rules, roles, and rights; and provides interoperability to support expansion and widespread use.

- VMware Blockchain offers a core enterprise blockchain platform that enables a shared source of truth and provides critical privacy, integrity, authentication, verifiability functionality, and native Daml integration. VMware Blockchain provides Day 2 operations functionality for critical financial market infrastructure, delivering the performance, monitoring, metrics, and enterprise-grade support essential to the continued smooth functioning of the repo markets.

The three partners have deep and complementary market knowledge. Each is committed to creating the repo markets of the future with a platform that solves the challenges of today’s markets and provides an enduring framework for future innovation.

What does Distributed Ledger Repo (DLR) achieve?

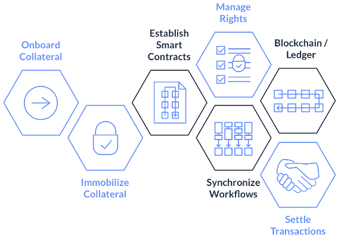

DLR provides a single platform where market participants can agree, execute, and settle repo transactions. It allows for the immobilization of the underlying securities in the repo transaction, while transferring ownership via smart contracts executed on the platform. The platform provides a synchronized and mutualized workflow with a single, real-time, always accurate source of data available to all participants.

Using the attributes of distributed ledger technology, the repo process and associated lifecycle events were modeled across sellers and buyers, from repo creation to maturity. Critical functionality is retained but improved:

- Market and processing rules are embedded, allowing every step to be validated and proved in a way that is observable and fully auditable.

- The legal terms of the different agreements are encoded and preserved, clearly identifying the roles, rights, and obligations of all parties.

- Privacy and data segregation are managed through deep integration between VMware Blockchain and Daml.

- Settlement takes place simultaneously, improving securities mobility while removing risk from the process by ensuring that secured parties remain secured.

Using Daml and VMware Blockchain’s highly scalable distributed ledger platform, Broadridge can provide a secure record of repo trade and collateral details which reduces the need for reconciliation and removes obstacles to straight-through processing.

DLR drives market efficiency with a unified view of the entire trade lifecycle and one source of truth that automates repo agreement terms and adheres to market rules. According to Mathieson, the ability to complete multiple actions concurrently improves operational efficiency and minimizes fails and disputes. Operating costs for repo activity profoundly decrease and counterparty risk is reduced while auditability and data visibility is increased.

What do you see as the path to market adoption?

Broadridge has conducted multiple pilots with buy- and sell-side firms and is currently onboarding several institutions to the platform. Implementation is low risk and low effort, perfect for an industry that is historically risk-averse and institutions that are constantly challenged on cost structure and return on capital.

- Daml is interoperable and can work with different databases, ledgers, or blockchain solutions. It’s easily adopted without expensive, time-consuming changes to existing technology stacks.

- Many institutions already use VMware’s solutions, which simplifies onboarding to DLR and provides a high degree of confidence in the platform.

Shastri adds, “Granular privacy, data segregation and trust are key requirements for adoption. The solution also needs to be highly performant to support high transaction volumes.”

VMware’s Scalable Byzantine Fault Tolerance with fast consensus – brings high performance, scale and efficiency to DLT, while maintaining the highest levels of data integrity. VMware Blockchain is also extensible so that multiple smart contracts in different languages can be run on the platform, enabling future flexibility to adapt in this rapidly changing space.

Broadridge sees a paced process of market adoption where each incremental step creates value. Importantly, Barakat notes that the platform is flexible enough to connect and operate with other platforms, whether or not they are DLT-based. This removes important barriers to adoption as those clients who use DLR can continue to transact with counterparties not yet on the platform.

What benefits have been delivered so far and what do you expect next?

Clients are already experiencing a profound reduction of risk and operational costs alongside enhanced liquidity. The way DLR is built on Daml and deployed on VMware Blockchain allows early adopters to realize immediate, meaningful benefits. One early use case, for example, improves the intracompany transfers and collateral movement between different entities of the same institution. This is especially relevant for large global banks with significant repo portfolios across different departments or entities and for those institutions engaging in bilateral repo.

As more counterparties are onboarded to the platform and the network expands, additional benefits and value will accrue.

What are the untapped opportunities? What do you envision as the future of a more efficient repo market?

Widespread adoption of DLR will create a standardized, more homogenous process for repos that reduces risk, improves efficiency, and is increasingly cost-effective. Ultimately this increases liquidity and minimizes capital utilization, which benefits all market participants.

Longer-term, we see opportunities to digitize collateral and extend support to additional asset classes. As Mathieson points out, “As capital markets continue to evolve, success or failure increasingly depends on the ability to quickly develop and test new applications to meet investor demand.” DLR offers the potential to rapidly develop and deploy new use cases for repo, with a faster go-to-market time that allows for innovation without compromising existing and essential market activities.

Blockchain is transforming the infrastructure for the financial markets. It provides several key ingredients: a single trusted source of truth, the intelligence of smart contracts, and auditability. Shastri adds, “Through a combination of smart contracts and blockchain, parties can independently verify the authenticity of data through cryptographic proofs, enabling multiple parties to interact with trust, while also having the right levels of privacy. The repo market is only the start. This has the potential to unlock value and enable new opportunities that may not be envisioned yet”.

“We see enormous potential for the future of repo,” says Barakat. “With traditional barriers gone, repo can expand to include new types and features that are relevant to a broader range of market participants. We’re excited to work with our clients to drive that innovation and growth in this critical market.”

Click to Read the Press Release