A Generational Opportunity to Improve the Transfer of Value

A Generational Opportunity to Improve the Transfer of Value

By Kelly Mathieson, Head of Enterprise Solutions at Digital Asset

10 years removed from the global financial crisis, can DLT deliver meaningful change in financial markets?

Financial markets today—structurally compressed

It goes without saying that the financial services sector broadly defined—banks, infrastructure providers, and other parts of the ecosystem—is a world which has been subjected to extraordinary change, certainly in the aftermath of the global financial crisis but really in the decades before then and since. Some of this change was fueled by the impact of financial regulatory reform, some by the advent of new technology, but the consequence of it all is an industry that has its fair set of challenges.

We’re dealing with an environment where revenues are lower than they've been in the past, or as some might say ‘structurally compressed,’ with generally low interest rates, low spreads, and high volatility that can be described as the painful kind that comes in fits and starts—and when it comes, is usually accompanied by a fair amount of illiquidity.

This low revenue environment is unfortunately coupled with a rising cost environment resulting in part from the ever-present need to reinvest in the suite of technologies that are necessary to keep businesses running, but increasingly from the need to comply with ever-changing regulatory requirements—which are very often being imposed on the back of infrastructures that were simply not designed or even contemplated to meet many of those demands, especially not in light of rising volumes. These factors are causing costs to rise continuously at a painful rate.

And at the same time, capital requirements for those required by statute to carry regulatory capital have been increasing more or less exponentially, so that the risk that you carry on balance sheet—and even those things not considered terribly risky on or off balance sheet—are now attracting far more capital than they ever did before.

Despite these issues there is nonetheless rampant competition, not only within the industry but also from newcomers to the industry who in many cases are not regulated, organized, or structured as conventional banks. The Fintech revolution has brought with it the emergence of many entities who enjoy an unlevel playing field where the unlevelness works in their favor.

So what does all this amount to? It amounts to an environment in which the ability to generate a return on equity that compares favorably with the actual long-term marginal cost of capital is extremely challenged—even for the best of class financial institutions.

That's a pretty tough environment in which to operate, of course.

Even if you're doing well running a market infrastructure that’s benefitted to an extent from increased centralization of certain activities—mandates for clearing, the increased value of data, and so on—it’s certainly the case that you have common customers around the world that are not entirely thrilled with the state of affairs, and so there’s a tremendous amount of pressure from this base to try to do things to reduce cost and improve the level of service.

DLT to the rescue?

It's in this context that the innovation that was originally triggered by the invention of the Bitcoin blockchain and the introduction of cryptocurrencies facilitated by it—nowadays more broadly understood as a collection of distributed ledger technologies known generically as DLT—has entered the scene.

What we have here is the convergence of a coincidence of need on the one hand, and on the other availability of a new technology that has uniquely differentiated characteristics from what’s been there before—and when need meets opportunity in a resource-constrained environment, that’s when things begin to get interesting.

So what exactly is DLT? Simply put, it is nothing more sexy than a radical new form of secure database architecture which—when you put it out that way—sounds spectacularly boring and immediately causes you to wonder “why all the hype?”.

While in the early days there was a lot of hype that preceded real substance, the hype was born by the power of the idea of decentralization and the close affiliation of the space with cryptocurrencies, which were part of the original invention and are themselves going through an extraordinary cycle that’s drawing a lot of interest. There’s no doubt that during the early stages of the development of blockchain, the close connection between cryptocurrencies and blockchain served as a distraction because the noise around the inappropriate—and in many cases illegal—activity that was being undertaken using cryptocurrencies meant that the promise of the technology was much less well advertised and held back as a consequence.

It took a while for that perception to dissipate, but dissipate it has; the ability to distinguish between cryptocurrencies and other uses of blockchain technology has become better understood. In this light, can distributed ledger technology ever live up to the great expectations that have been raised around it? The short answer is yes.

When you first begin to imagine the potential of the technology in highly regulated market environments, it becomes very clear that many of the attributes of the original blockchain conceptualization that facilitated the creation of cryptocurrencies really need to be modified very materially in order for it to become suitable, applicable—or even legal—in the context of regulated financial services.

We’ve now had three or four years of extensive industry-wide research and development which has gone into making enterprise deployments of this technology viable. This work has addressed some of the design differences needed to diverge from the public blockchain concept in order to actually deploy this technology in an enterprise context, particularly around financial services that are regulated and involve the transfer of large amounts of value—where things like transparency (both to regulators and customers), auditability, reversibility, and capacity to process gigantic volumes and throughput rates of transactions are all critical, and where it is vitally important that confidential and sensitive market information be kept private where that is appropriate and necessary.

This work is not complete, but it’s materially advanced, and it is no longer informed to state that smart contracts and distributed ledgers can’t handle the needs of financial enterprises. Fascination with distributed ledger technology is more than a passing trend; it’s evolved from a frequent discussion topic among engineers and enthusiasts into a conversation shared between global financial institutions, central banks, regulators and business leaders around the world.

DLT is not about disintermediation—it’s about adding value

The birth of Bitcoin—which not coincidentally aligned with the global financial crisis—was driven by a desire for the peer-to-peer exchange of value, riding a wave of negative feelings towards financial intermediaries based on a perception that they exist in a way that purely adds friction to the system for the sole purpose of extracting profit for valueless or low-value service. While it is true that some in the financial services ecosystem do just that, many play very highly value-added roles. They form a regulated framework, bring capital to the table to ensure systemic stability, inject liquidity and credit capacity, provide advice, take custodial responsibility for people’s assets (and the legal consequences for mistakes in that area)—the list goes on and on. We need to collectively do a better job of conveying to the outside world the value that financial services drive in our economy.

You could imagine a world where all financial intermediaries are eliminated—and there may be cases where it would be beneficial to the endpoints of the system to have that happen—but the reality is that many who provide infrastructures and services actually would be thrilled and delighted to spend less cost, have less errors, better delight their customers and focus on the value-added aspects of their job. So if we merely enable intermediaries to do a better job, charge their customers less for useless services that they have to do—like reconciling two pieces of information that should be the same but for some inexplicable reason have become different—that’s an amazingly powerful opportunity.

It isn’t going to be the case that DLT puts everybody who’s an intermediary out of business. The technology is going to refine or sieve through the intermediation functions and ensure that the higher value-added ones remain and the others get jettisoned. If you don't jump on that bandwagon then yes, you will get disintermediated, because someone else will come along and be a better intermediary.

No, DLT is not about disintermediation. The real problem to be solved is that there are significant bodies of transactional load involving multiple parties who have a shared interest in correctly reporting the transactional arrangements between them: there are clearing entities who have legal responsibilities; there are regulators who have reporting requirements; there are many different inputs to the correct processing of the transfer of value.

The obvious DLT value proposition for financial markets

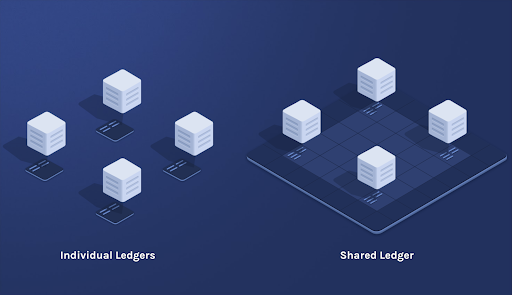

In this context then, what does this new form of secure database architecture allow us to do? Well, simply this—for the first time, it allows independent entities who may be competitors, or even adversaries, that have a common interest in a workflow or process to be able to intentionally share a common record of that workflow or process for the premising of value—not just information, but the transfer of items of value: whether that is securities, derivatives, money, commodities, or anything else. And to do that in a cryptographically secure environment where no one party can unilaterally edit the contents of what is in that database.

Allowing transacting parties to rely on a shared, replicated, secure, independently validatable golden record of all activity enables some very important things.

It allows for the first time mutualization of infrastructure and the opportunity for massive cost savings by essentially being able to eradicate zero-value added work associated with reconciliation—the ticking and tying of different records across different entities which have to coordinate and agree. Materially reducing the need to reconcile all the complexities associated with trading can free up tens of billions of dollars a year in financial services alone. Operating from a common record will also reduce the number of errors that lead directly to reconciliation differences.

The mutualization of infrastructure leads to numerous opportunities for both efficiency and new value-add services.

This in turn has led to a quick realization that there is opportunity to improve efficiency and streamline workflows, to reduce delays, and speed up processes like settlement—which has knock-on implications for reducing capital requirements as assets are able to flow through these workflows at a higher speed and remain on expensive balance sheets for less time.

You don’t have to compromise by blindly trusting your counterparty or a third party to provide you with the truth of that record. You’re able to independently validate it with mathematical certainty. And you’re not required to compromise on the privacy and confidentiality of your proprietary activity. The efficiency gains in financial markets use cases—both the cost and the material risk reduction—can lead to margin and liquidity need reductions.

DLT has been regularly promoted as an enormous cost savings and efficiency tool—targeting not the 5%-10% yearly savings that we all squeeze out through normal efficiencies, but material cuts in the 30-50% territory by truly sharing things that aren't value-added capabilities. Do this in an environment where revenues are low, costs are high, and capital requirements are high and this is a truly meaningful opportunity!

But that’s just the Version 1.0 story around DLT.

The non-obvious value of DLT for financial markets

This is a time of furiously paced technology-driven innovation, and what you hear about today from some of the world’s most advanced users of this technology goes well beyond the original understanding. We’re now talking about creating the opportunity to develop new services—value-added, revenue-generating services—that aren’t just about agreeing on simple facts.

It certainly wasn't clear at the beginning of this journey that this would be the case, but it is increasingly evident that a foundation of accurate, synchronized data within financial infrastructures will unleash the sort of web-paced innovation that the advent of the Internet unleashed 20 years ago.

Data powers everything in the connected economy. Increasingly, financial firms are reorienting their strategies around digital transformations that speak to the imperatives of enhanced customer experience, process simplification, cost reduction, AI, machine learning, big data analytics, quantum computing, speed and accuracy—all of which has to have a foundation of accurate underlying data.

If you’re spending 90% of your time disagreeing with each other about the accuracy of the record that you both actually did, that as many as a dozen entities had a stake in depending on your market, how are you ever going to intelligently delight your customers?

DLT isn’t just about cutting costs, it’s about deeply connecting independent entities in a way that preserves privacy while coordinating multi-party workflows across those entities with guaranteed integrity, confidentiality at scale and enhanced quality of data.

The revolution that’s going on here is in many respects similar to the revolution that was triggered by the invention and popularization of the Internet. The only difference is that the internet started off being about the free flow of information, and what we’re talking about here is liberating the transfer of value and associated automated workflow processing around that—saving hundreds of billions of dollars of cost and unleashing unprecedented innovation.

Think about the platform businesses that were born out of the Internet era that have now become the giants—Facebook, Google, Amazon and so on—what they are at their core are technology-enabled platforms whose value derives from the activities that their customers conduct on those platforms. Obviously the things that have come from that have been mind-blowing in the scope and impact they’ve had on our world.

It is extraordinary that we haven’t seen something similar to that in financial services. But make no mistake, this change is coming.

The value of franchises are less described by the value of the transactions they process than by the value of the networks they create and the business they enable their customers to conduct. And who has better networks than financial markets?

The incumbent market infrastructures—exchanges, clearing houses, CSDs, and the like—and their major customers (the custodians, investment banks, broker-dealers) have significant existing connectivity to a very broad network of customers. In fact, they join at the dots in the financial ecosystem, particularly market infrastructure providers who are connected to both the buy side and the sell side, and the custodians, and so on and so forth.

And because they have the advantage of existing customers, trusted relationships—and very often the imprimatur of regulation that allows the rule of law to govern the activities that they oversee—there is actually an inherent advantage if they move sufficiently quickly to evolve and adapt this technology because they’re already positioned with the existing relationships, the existing revenues, the existing knowledge of the existing processes and problems.

Rather than aiming this technology at the far ends of their ecosystem and trying to take them out of the middle, they are front and center at the heart of a real transformation in how value is transferred.

It’s from this that the real excitement arises.

Digital Asset offers several paths forward

Digital Asset was founded in 2014 with a mission to unleash web-paced innovation for processing every asset, transaction, and workflow across companies. We believe that DLT platforms alone do not get you there; synchronized multi-party business process orchestration can only come about if there is a massive increase in developer productivity brought about by abstraction of distributed workflow execution. To this end we have developed a purpose built smart contract language, DAML, that abstracts away underlying complexities and synchronizes data across organizations. Our holistic approach focuses on rapid prototyping, continuous integration, continuous deployment and continuous audit.

This strategy is paying off in financial markets, as evidenced by two recent client announcements. At the end of 2018, the ASX committed to use our technology to develop a clearing and settlement solution (CHESS replacement) for the Australian cash equities market—this new system is on-target to go online in March or April of 2021. Also at the end of 2018, HKEX Chief Executive Charles Li kicked off Hong Kong Fintech Week by announcing a partnership with us to develop a blockchain-powered post-trade allocation platform for their Northbound Stock Connect program.

To illustrate the power of DAML in modeling key financial flows, we have built a set of functionally rich reference applications in DAML and will very shortly begin making these applications generally available at no charge. Use them to learn DAML modeling techniques, to generate ideas for innovative new services, or as the seeds for your own production-level workflows. A few examples of the applications we will be shipping include:

- Derivatives Lifecycle - modeling of the margin management workflow, including margin call tracking, collateral availability, and the tagging or identification of assets on the DA Platform that facilitate collateral eligibility, allocation and mobility.

- Swaps - models that provide the workflow foundation for basic swap 'negotiated' events (e.g. novations and term changes) and ‘derived' events (e.g. resets and interest rate payments), as well as a basic UI to trigger negotiated events and highlight upcoming derived events.

And for those of you already on the path of building workflows in DAML, we will be rolling out a set of reusable DAML patterns and libraries for common use cases to help you accelerate your development. For example:

- A rendering of the ISDA Common Domain Model (ISDA CDM™) in DAML. CDM is a digital blueprint for how derivatives are traded and managed across the trade lifecycle.

- A DAML rendering of FpML (Financial products Markup Language) for OTC derivatives workflows.

As these applications and libraries roll out, we will use this blog series to provide more information on the individual use cases. Use these applications to kick-start your journey forward to capturing the promises of DLT.

Follow us on Medium or Twitter, or join the community and register to download the DAML SDK Developer Preview at www.digitalasset.com.

About the author

Kelly Mathieson is Head of Enterprise Solutions at Digital Asset, the leading provider of smart contract and distributed ledger technology for business processes across financial services and a broad range of industries. She also serves on Digital Asset’s Executive Management team.

Prior to Digital Asset, Kelly spent 26 years at J.P.Morgan and 3 years at Goldman Sachs working across Corporate & Investment Bank, Asset Management and Treasury & Securities Services businesses. She was most recently Head of J.P.Morgan’s Global Collateral Management and Securities Clearing and played an instrumental role the Federal Reserve Bank of NY Repo Reforms in the wake of the 2008 global financial crisis.

Earlier in her career at J.P. Morgan, Kelly served as Head of Global Custody Product and Head of Online Brokerage Product Asset Management as well as other product management and marketing positions in securities lending, liquidity management, futures and options clearing, FX and commodities managed funds.

Kelly serves on the Greater NYC Board of the Susan J. Komen Foundation. She has been honored to receive several industry acknowledgments, including Global Custodian’s 2018 Person of the Year and American Banker’s Most Powerful Women in Banking to Watch 2011 and 2012.